URD 2023

-

Presentation

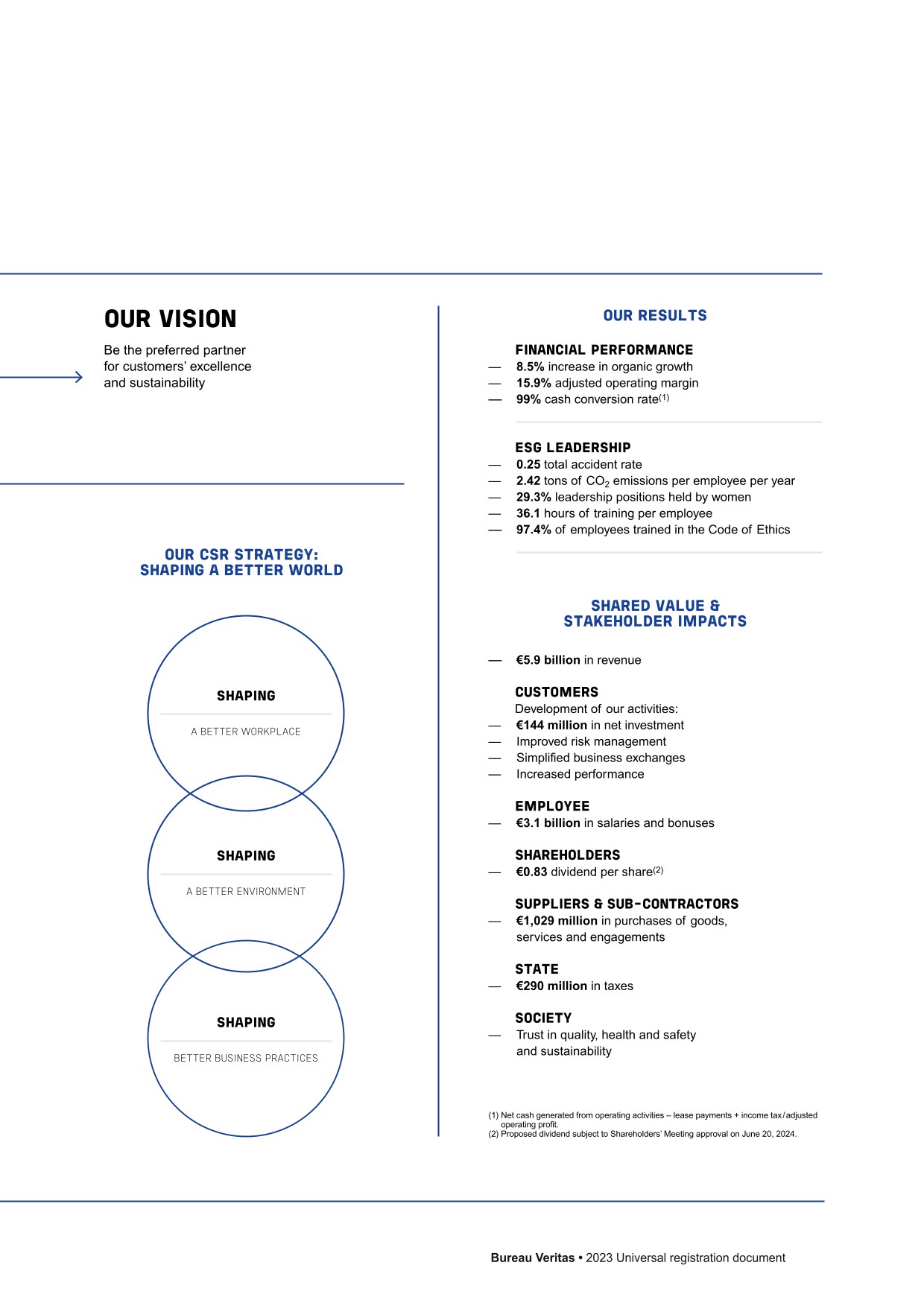

of the Group1.1General overview of the Group

Mission

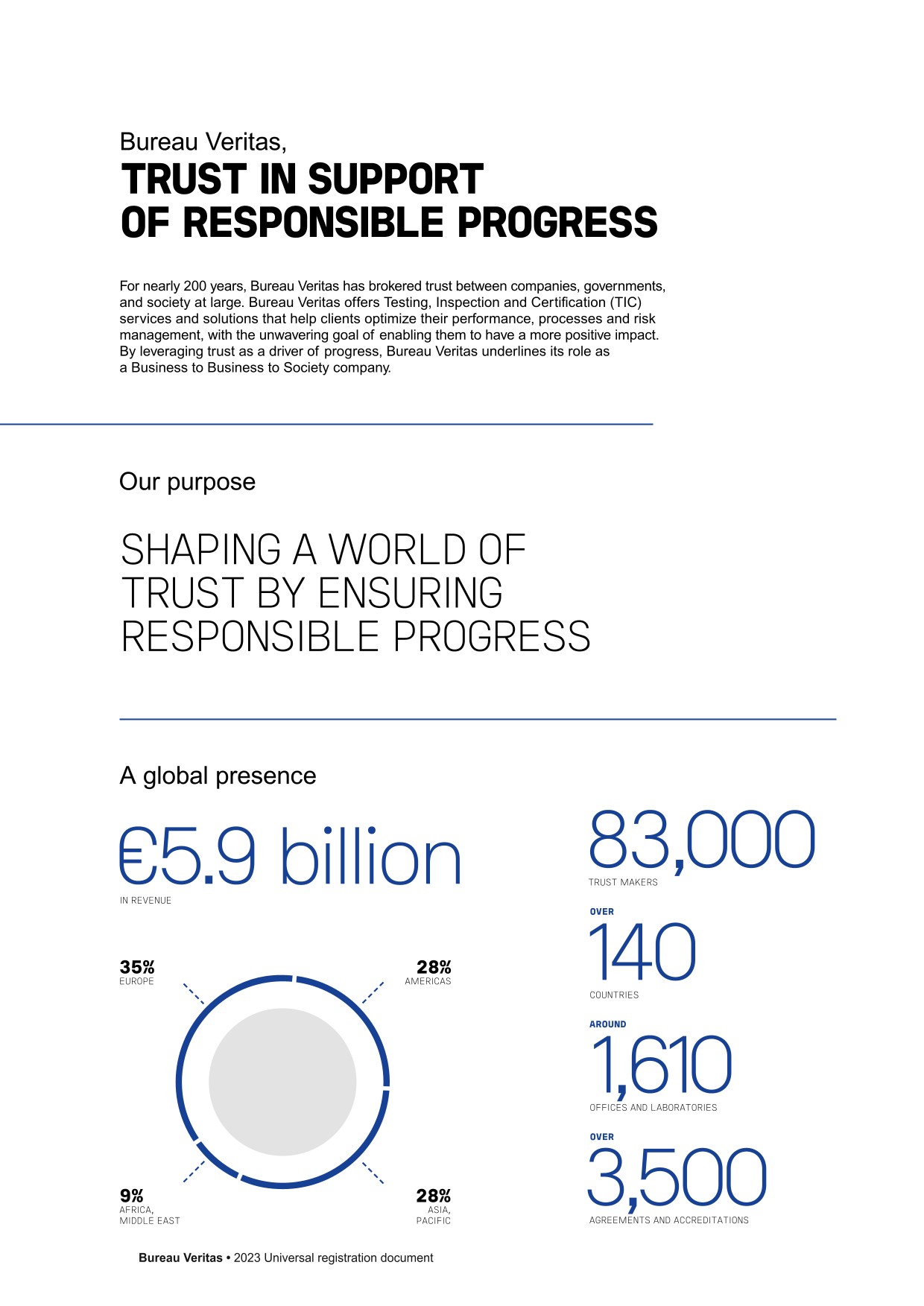

Bureau Veritas is a world leader in Testing, Inspection and Certification (TIC) services. The Group helps strengthen trust between companies, authorities and consumers. Its mission is to reduce its clients’ risks and improve their performances. It also supports its clients with their innovations in the areas of quality, health, safety and sustainable development.

Bureau Veritas is recognized for its expertise, impartiality, integrity and independence, acquired over its 190 years of existence.

The services provided by Bureau Veritas are designed to ensure that products, assets and management systems conform to given standards and regulations in terms of quality, health, safety, environmental protection and social responsibility (QHSE).

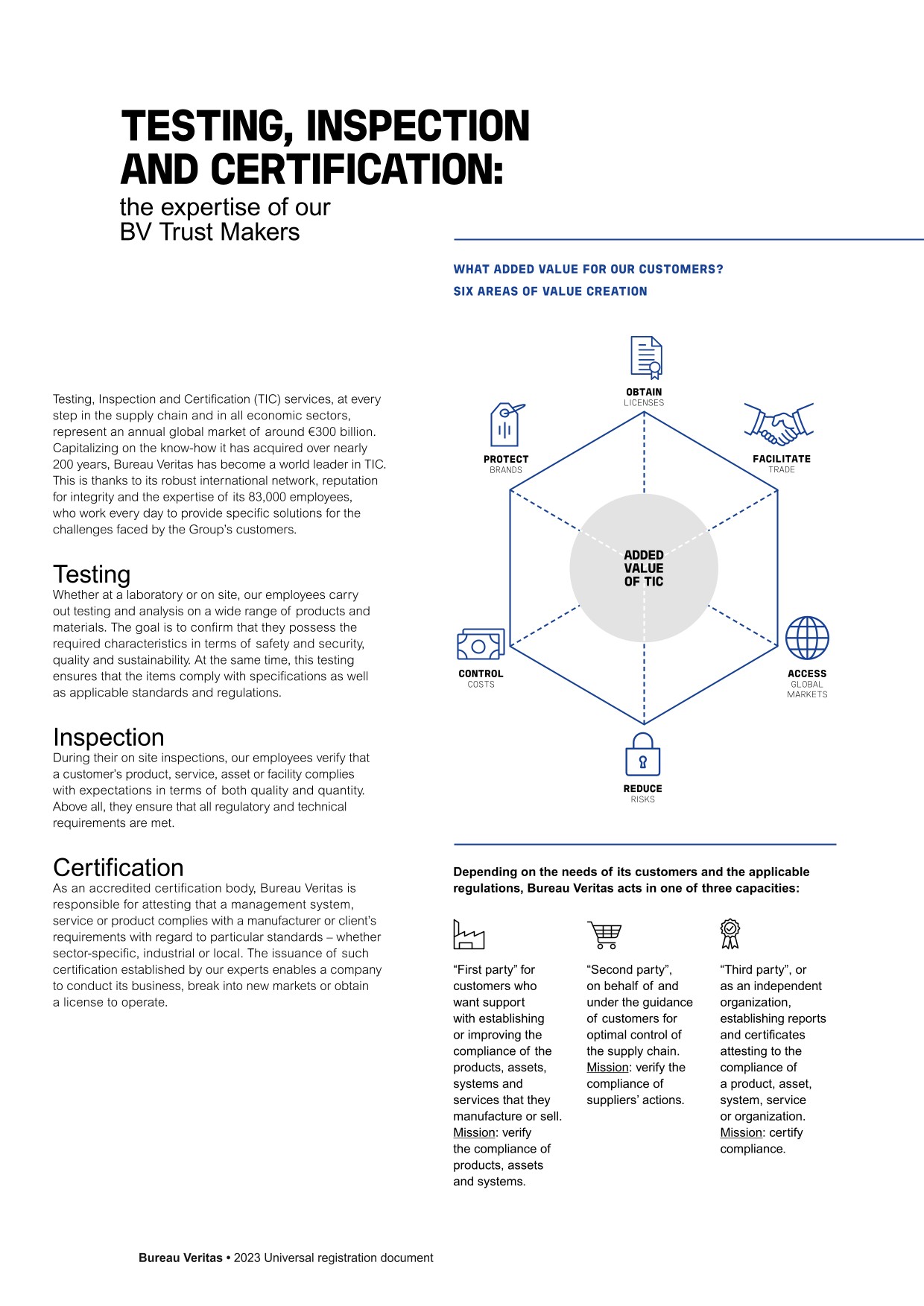

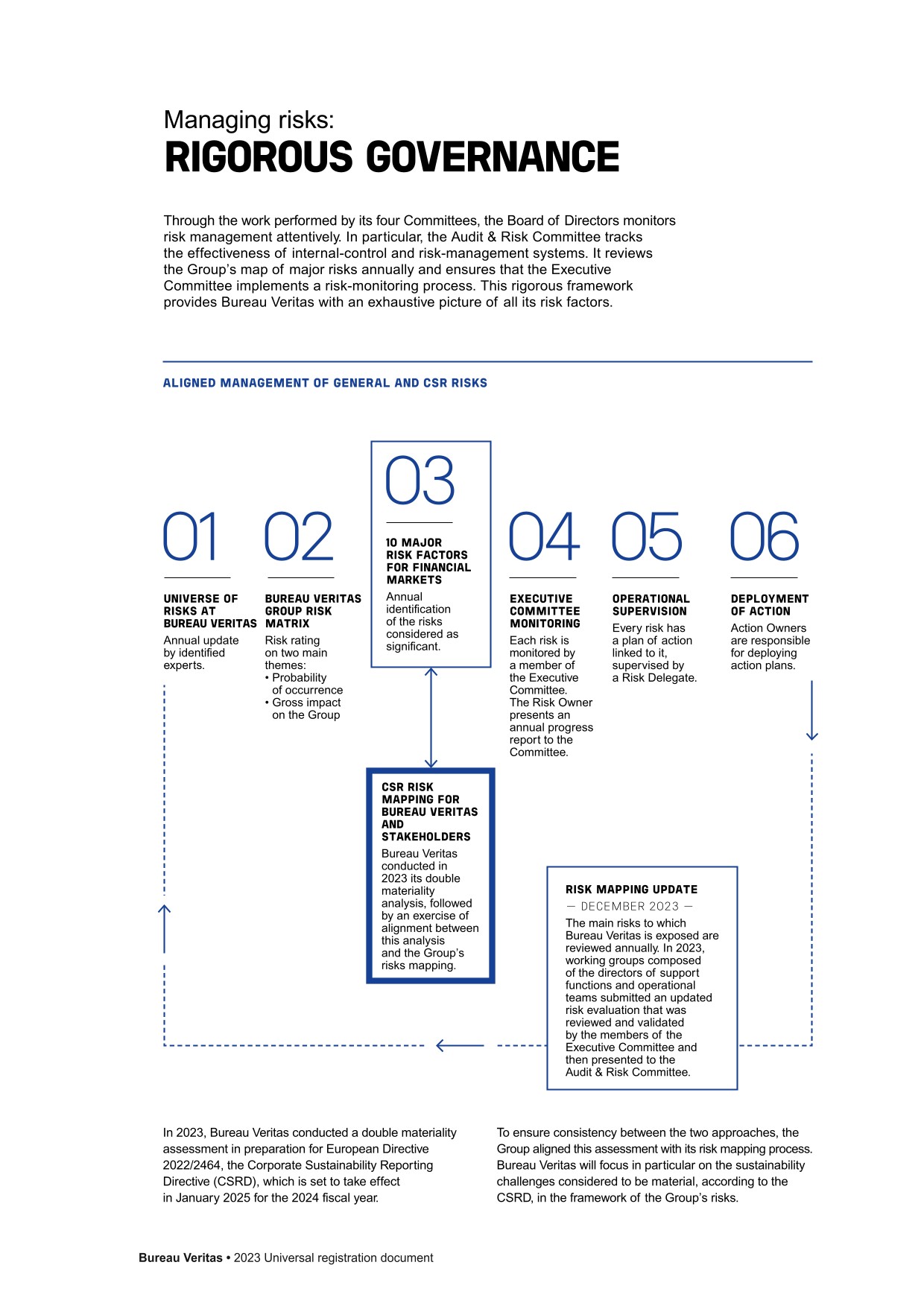

Depending on its clients’ needs and on applicable regulations, standards or contractual requirements, Bureau Veritas acts:

- ●as a “third party”, independently issuing reports and conformity certificates for products, assets, systems, services and organizations;

- ●as a “second party”, on behalf of and upon the instructions of its clients to ensure better control of the supply chain; or

- ●as a “first party”, on behalf of clients seeking support in ensuring or improving the conformity of their products, assets, systems and services.

Obtaining a license to operate

Companies must prove that they are compliant with a large number of standards and regulations. Bureau Veritas helps them by providing its in-depth expertise on the standards applicable to their businesses. As an independent third party, Bureau Veritas verifies that companies comply with these standards. This allows them to conduct and develop their businesses in compliance with local and international regulatory requirements and thereby to obtain and maintain the necessary licenses to operate issued by public authorities.

Facilitating trade

International trade relies on third-party players who certify that the goods exchanged comply with the quality and quantities stipulated in commercial contracts. Bureau Veritas plays a key role in these transactions by testing materials, verifying that goods comply with contractual specifications and validating quantities. Exchanges of commodities, for example, are based on certificates issued by companies such as Bureau Veritas.

Accessing global markets

Capital goods and mass consumer products must meet national and international standards before being sold on the market in a given country. These standards act as technical trade barriers within the meaning of the WTO. Companies design and manufacture their products and equipment in accordance with the standards of different countries. They call on Bureau Veritas to carry out tests and optimize their test plan, with the aim of getting their products to market faster.

Reducing risks

Managing risks relative to quality, health, safety, environmental protection and social responsibility improves the efficiency and performance of organizations. Bureau Veritas helps its clients to identify and manage these risks, from project design to completion and decommissioning.

Controlling costs

Second- and third-party testing, inspection and auditing methods allow companies to determine the true condition of their assets. This enables them to launch new projects and products with the assurance that costs, timing and quality are under control. During the operational phase, inspections help optimize maintenance and extend the useful life of industrial equipment.

Protecting brands

The huge rise in the use of social networks has transformed how global brands are managed. Brands may quickly find themselves impacted by a malfunction in one of the links in their supply or distribution chain. Bureau Veritas helps companies better manage these risks, by conducting analyses as a highly reputed independent global player.

-

1.2History

1828: Origins

-

1.3The TIC industry

To the Group’s knowledge, there is no comprehensive report covering or dealing with the markets in which it operates. As a result, and unless otherwise stated, the information presented in this section reflects the Group’s estimates, which are provided for information purposes only and do not represent official data. The Group gives no assurance that a third party using other methods to collect, analyze or compile market data would obtain the same results. The Group’s competitors may also define these markets differently.

1.3.1A market estimated to be worth close to €300 billion

Services related to quality, safety, performance, sustainability and responsibility are termed as Testing, Inspection, and Certification (TIC). TIC tasks range from on-site tests and supply chain inspections to data verifications. They can be carried out at any supply chain stage, in all sectors, and by various private or public parties.

The TIC market size is tied to the value and risk of products or assets. The "TIC intensity" corresponds to the fraction of an item's value dedicated to controlling this asset or product. Typically, this fraction ranges from 0.1% to 0.8%. The TIC market's value is determined by multiplying the TIC intensity by the amount spent on goods and products by manufacturers, operators, buyers and sellers.

-

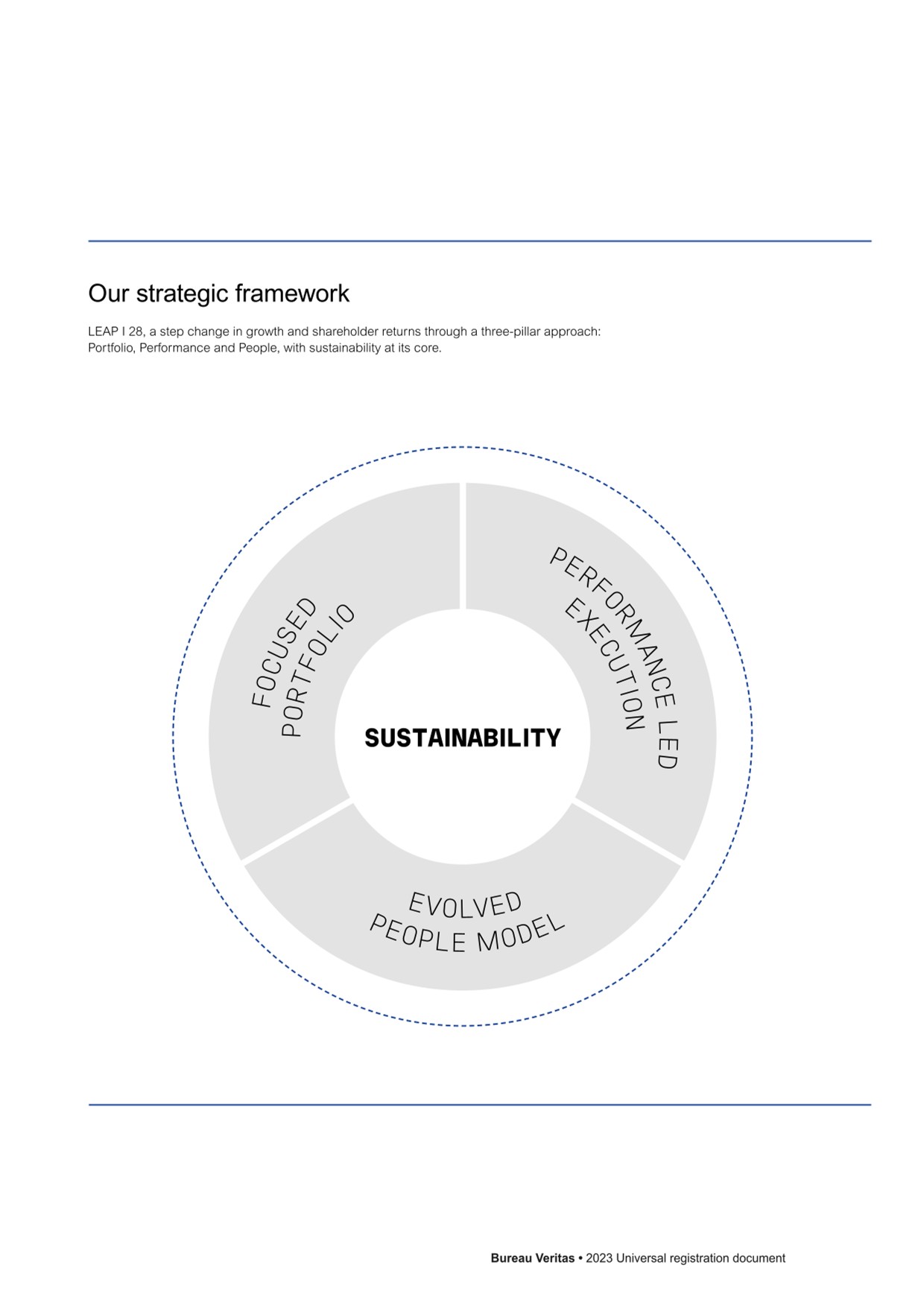

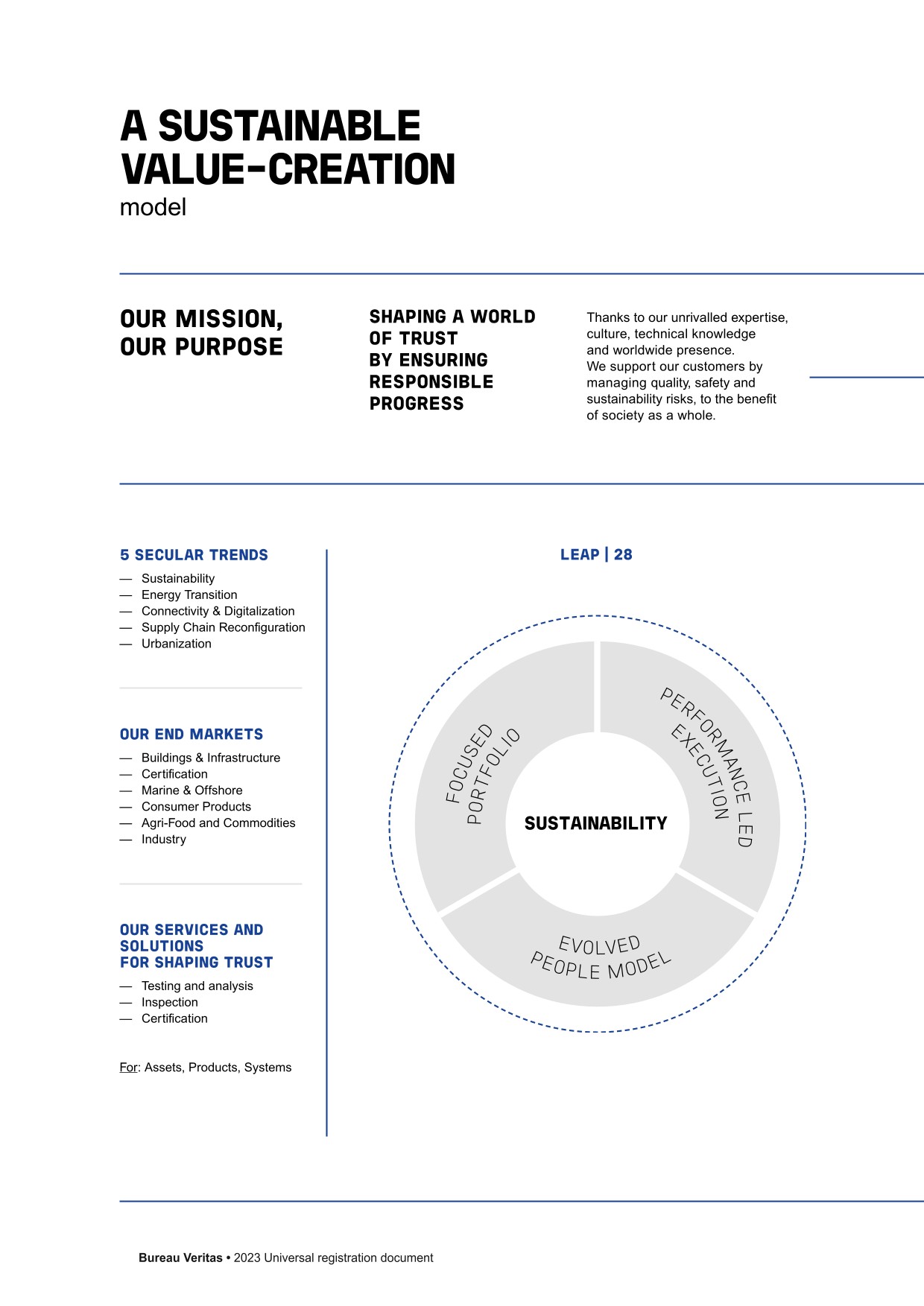

1.4Group’s strategy and objectives

1.4.1Key competitive advantages

The Group benefits from an efficient international network

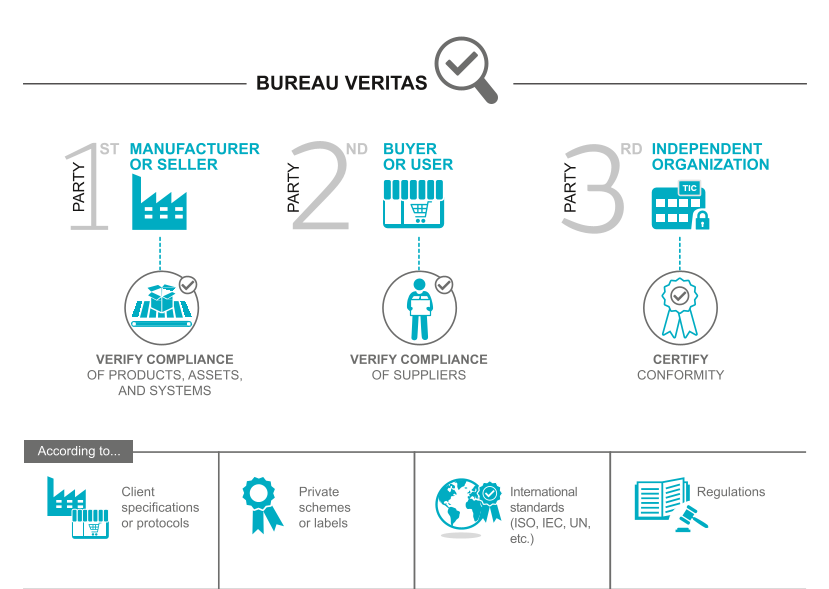

Bureau Veritas boasts a vast global network with more than 1,600 offices and labs in almost 140 countries across the world.

Countries with established economies, such as France, the US, Canada, Japan, the UK, Spain, Italy, the Netherlands, Australia, and South Korea, feature a prominent presence of Bureau Veritas. These nations have strong regulatory frameworks, and the Group is recognized for its technical prowess and modern production techniques.

In rapidly developing economies, like China, Brazil, Chile, Colombia, the United Arab Emirates, and India, Bureau Veritas has secured strong footholds for a sustainable growth. The Group has fostered a significant local presence over time in these regions and continues to grow by inaugurating new offices and labs.

The scale of the Group’s network is a core asset, offering value and differentiation on both commercial and operational levels.

- ●On the sales front, this vast network empowers Bureau Veritas to cater to key accounts. This enables securement of significant international contracts, which are becoming an increasingly substantial portion of its activities.

- ●Operationally, the Group capitalizes on its scale to enhance profitability. Economies of scale arise from shared office spaces, back-end operations, IT resources, and the distribution of costs associated with innovating in new services and standardizing inspection procedures over a broader base.

With a regional hub organization in pivotal countries, Bureau Veritas efficiently distributes knowledge, technical aid, and sales teams throughout areas. In the future, the Group envisions fortifying this hub-centric network structure, leveraging the benefits of scale.

A strong image of technical expertise and integrity

Bureau Veritas has built a successful global business based on its long-standing reputation for technical expertise, high quality and integrity. This reputation is one of its most valuable assets and is a competitive advantage for the Group worldwide.

Technical expertise recognized by authorities and by many accreditation bodies

Throughout its history, the Group has honed expertise across diverse technical fields and developed a comprehensive understanding of regulatory landscapes. At present, Bureau Veritas holds accreditation from numerous national and global delegating authorities and accreditation bodies, either as a second or third party. The Group persistently works to uphold, refresh, and broaden its array of accreditations and approvals. Regular inspections and audits by these bodies ensure the Group’s procedures, staff qualifications, and management systems adhere to the necessary standards, rules, and regulations.

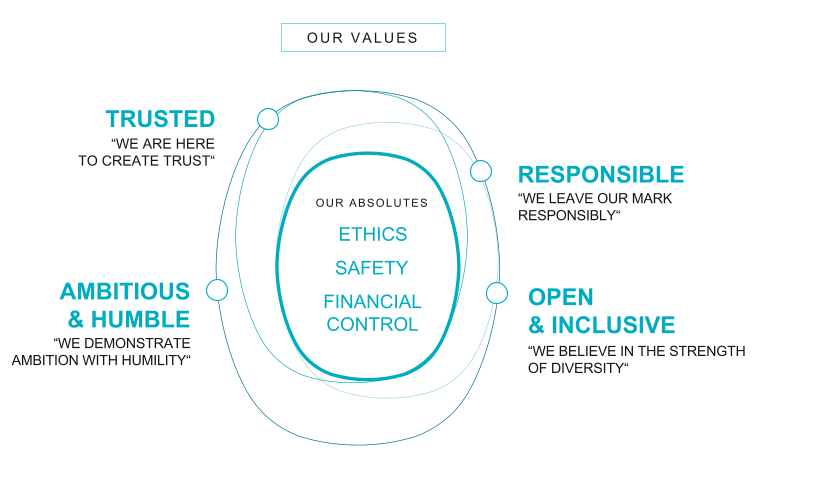

Quality and integrity embedded in the Group’s culture and processes

Bureau Veritas places paramount importance on values like integrity, ethics, impartiality, and independence. These core values not only shape the brand’s reputation but also enhance its value to clients. In 2003, with the guidance of the TIC Council (an international body representing independent testing, inspection, and certification firms), these values were at the heart of the efforts in the TIC profession. This collaboration culminated in the creation of the Group’s inaugural Code of Ethics, released in October 2003 and regularly updated since then.

A profitable growth model supported by strong cash generation

Bureau Veritas’ financial structure is built on a robust foundation that hinges on four essential characteristics:

- 1 .Dual growth drivers: The financial model leverages two primary streams for growth:

- ●organic growth,

- ●supported by strategic acquisitions.

- 2 .Profitable growth model: Bureau Veritas’ historical adjusted operating profit margin stands at circa 16%. It signals the Company’s ability to effectively manage its operations and maintain profitability even in challenging circumstances.

- 3 .Steady cash flow generation: over the last half-decade, the Group has consistently delivered free cash flow above €600 million. This is due to the significant efforts deployed to monitor and optimize its cash flow and liquidity, especially when it comes to working capital requirements.

- 4 .Rigorous capital allocation strategy: Bureau Veritas operates with a strict capital allocation philosophy.

-

1.5Presentation of business activities

1.5.1Marine & Offshore

Group revenue

Group adjusted operating profit

A portfolio offering high value-added services to a loyal client base

Bureau Veritas verifies that ships and offshore facilities comply with classification rules, mainly as regards the robustness and reliability of equipment. This mission is usually carried out together with the regulatory certification mission essential for operating ships. Marine insurance companies require such certificates to provide coverage, and port authorities also check that valid certificates exist when ships come into port. It is also essential for operators to make sure that their offshore facilities are in line with applicable safety and quality standards, as well as regulatory requirements.

Bureau Veritas Marine & Offshore services help clients comply with these regulations. They also help them reduce risk, extend asset lifecycles and protect the marine environment.

The Group is involved from the construction phase, approving drawings, surveying the shipyard and inspecting materials and equipment. Experts then make regular inspections throughout the vessel’s lifetime to provide ongoing oversight. Bureau Veritas provides a range of technical services, including asset integrity management. On behalf of its clients, the Group monitors any changes in regulations, identifies applicable standards, and liaises with the authorities. It also informs them about the compliance process and carries out design and execution reviews.

The Group has diversified its services: first by providing loss adjustment and risk assessment for the offshore industry and later marine accident investigations, pre- and post-salvage advice and the refloating of vessels. In 2018, it created Bureau Veritas Solutions Marine & Offshore (BV Solutions M&O). In 2023, 40% of Bureau Veritas Marine & Offshore revenue was generated by the certification of ships under construction, while the remainder was generated by the surveillance of ships in service and complementary services.

Bureau Veritas is a member of the International Association of Classification Societies (IACS), which brings together the largest international classification societies. Together, these companies classify around 90% of the world’s ships. The rest of the world’s fleet is either classified by small companies or not classified at all.

Worldwide network

To meet the needs of its clients, the Marine & Offshore network has 2,900 experts in 90 countries. In addition to 19 local design approval offices (located near its clients), the Group’s network of 180 control stations gives it access to qualified surveyors in the world’s largest ports. This means that inspections can be conducted on demand and without the delays that could be detrimental to the ship’s business and owner.

The worldwide fleet continues to expand

Maritime trade has been on the rise since the early 2000s, except in 2020 due to the Covid-19 pandemic. In 2023, orders for new ships and renewal of the worldwide fleet continued to see good momentum, above the trends observed since 1996. Demand is mainly for LNG carriers and container ships, as orders for bulk carriers and tankers decline.

Bureau Veritas classifies a wide range of vessels

Bureau Veritas is the world leader in terms of the number of classified ships and ranks number five worldwide in terms of tonnage with a greater market share in 2023. The Group has expertise in all segments of maritime transport, spanning different types of vessel including bulk carriers, oil and chemical tankers, container ships, gas carriers, passenger ships, warships and tugs. It also has expertise in offshore facilities designed for the exploration and development of coastal and deep-water oil and gas fields (fixed and floating platforms, offshore support vessels, drill ships, subsea equipment). Bureau Veritas also holds the leading position in the market for highly technical ships such as liquefied natural gas (LNG)-fueled vessels, LNG or liquefied petroleum gas carriers, and other types of specialized vessels and equipment.

Bureau Veritas supports the maritime industry in its various advances and innovations, from Arctic shipping to LNG supply chains. It also supplies new solutions and ratings to ensure on-board safety and supports technologies ranging from alternative fuels to on-board autonomy.

A diversified and loyal client base

- ●shipyards and shipbuilders around the world;

- ●equipment and component manufacturers;

- ●ship owners;

- ●oil companies and Engineering, Procurement, Installation and Commissioning (EPIC) contractors involved in the construction and operation of offshore production units;

- ●insurance companies, P&I (Protection & Indemnity) clubs and lawyers.

Changes in the order book

Changes in the Group’s in-service fleet

A changing market

A changing regulatory environment

International regulations applicable to maritime safety and environmental protection are evolving rapidly, providing classification companies with growth opportunities and momentum. These include:

- ●Reduction in greenhouse gas (GHG) emissions: with the introduction of new regulations adopted under the aegis of the International Maritime Organization (IMO) and the European Union, new and existing ships must improve their energy performance. Bureau Veritas can play a crucial role in certifying compliance with the new EEXI and CII standards.

- ●The EU’s “Fit for 55” package: these measures set out a roadmap for achieving the European Union’s goal of reducing GHG emissions in the EU by at least 55% by 2030 as part of the European Green Deal. Bureau Veritas offers audit, inspection and certification services to help maritime companies comply with these requirements.

- ●The Ballast Water Management (BWM) Convention adopted under the aegis of the IMO: this entered into force in 2017 and gives classification societies a greater role in verifying the effectiveness of ballast water management systems.

- ●Ship recycling: the Hong Kong international convention and European regulations in this area offer opportunities for ship recycling inspection and certification services. Under the EU’s Ship Recycling Regulation (applicable at the end of 2018 for new ships and as from January 2021 for existing ships), ships are required to have on board an Inventory of Hazardous Materials (IHM).

- ●Regulations applicable to ships for inland navigation transporting hazardous materials: Bureau Veritas is one of three classification societies recognized by the European Union.

- ●Cyber resilience: the IACS (International Association of Classification Societies) unified requirement concerning the on-board integration of computer-based systems came into force in 2016. It has since been rounded out by new rules for cyber resilience of on-board systems and equipment.

- ●A “safety case” system for the offshore industry: this development requires the expertise of an independent body which Bureau Veritas can provide.

- ●Monitoring, Reporting and Verification (MRV) and Data Collection System (DCS): the EU and IMO have introduced regulations on the monitoring, reporting and verification of carbon dioxide emissions and on the collection of ships’ fuel consumption data. These rules are designed to further drive decarbonization efforts in the maritime sector.

- ●The Polar Code and ban on heavy fuel oil: the “Polar Code”, or “IMO Guidelines for Ships Operating in Polar Waters” came into effect in January 2017. The IMO’s ban on the use of heavy fuel oil in the Arctic region has also been in place since January 1, 2024.

All these factors require technical and regulatory know-how, which is at the heart of Bureau Veritas’ expertise. As a classification and certification company, the Group is well positioned to help maritime companies navigate this complex and fast-changing regulatory landscape.

A Green Line of services and solutions dedicated to the protection of the maritime environment and that meets the industry’s decarbonization imperatives

Bureau Veritas plays a key role in supporting the maritime industry in its energy transition. In the face of major challenges in terms of the environment and greenhouse gas emissions, the Group is actively committed to steering the maritime industry towards solutions that are both sustainable and environmentally friendly.

The maritime industry recognizes the importance of propulsion technology choices in the current climate emergency. The deadlines set by the IMO from 2023, then 2030 and 2050, entail difficult decisions for ship owners. By the end of 2023, approximately 50% of orders for new ships were based on dual-fuel systems. LNG, with its potential to reduce emissions, is seen as a particularly critical transition fuel. Methanol is also emerging as a relevant option, particularly for container ships.

Offshore markets, meanwhile, are focusing on gas projects, not least because of geopolitical changes in Europe. These developments open up new opportunities over the coming years. In order to maintain current production levels and replace older infrastructure, investments continue to be made in the offshore oil sector. The market has also seen a significant rise in investments from oil companies in offshore projects for both fixed and floating wind farms. Considerable investments were made in wind farm installation and maintenance vessels.

As an independent body, Bureau Veritas plays an essential role in assessing new technologies for ship owners, shipyards and suppliers. It offers critical expertise from the earliest stages of design through to delivery, and throughout the assets’ lifecycle.

Through its Green Line offer, Bureau Veritas provides a wide range of services to support the shipping industry, such as:

- ●developing and implementing standards for new alternative propulsion solutions and fuels, validating their sustainable origin, developing dedicated infrastructures and providing project assistance;

- ●reducing the risks associated with new projects through approvals in principal (AiP), which are designed to provide an independent opinion on the risks and reliability of the design;

- ●voluntary sustainability initiatives, through the Sustainable Ship ratings, which recognize efforts to reduce pollution and emissions, protect marine ecosystems, recycle ships and improve well-being on board;

- ●onshore & offshore wind lifecycle solutions;

- ●engineering services for sustainability performance and sustainable construction in shipyards;

- ●responsible fishing practices;

- ●crew and passenger safety, and on-board health, safety and hygiene protocols;

- ●electrifying sea-going vessels.

Bureau Veritas Marine & Offshore recently published two white papers, the first on alternative fuels (“Alternative Fuels Outlook”) and the second on the decarbonization of the shipping industry (“Decarbonization Trajectories – Sharing Expertise: Realistic Approaches to Shipping’s Decarbonization”). These papers are designed to guide and raise awareness of the challenges facing the shipping industry.

In 2024, the decarbonization of shipping will undoubtedly be at the heart of the industry’s major challenges. Bureau Veritas will continue to support its ship owner, shipyard and charterer clients in transitioning to cleaner energy, lending invaluable technical expertise to solutions for today’s and tomorrow’s world.

Development of a higher value-added digital service offering

Efficiency is at the heart of digital classification

The digital revolution in the maritime industry is gathering momentum. Bureau Veritas Marine & Offshore is at the forefront of this revolution, reinventing the role of technology in classifying ships and offshore facilities. By leveraging new tools including digital twins, drones, remote virtual tours, artificial intelligence and cloud platforms, the Group can help its clients make safer, more effective, data-driven decisions.

- ●3D classification, which is bringing the design review and monitoring process for the construction of new vessels and offshore facilities into the digital age using a 3D model. By using 3D models, all stakeholders – ship owners, shipyards and Bureau Veritas – can work together more effectively. This real-time collaborative platform offers unrivaled efficiency, enabling rapid adjustments and dynamic exchanges;

- ●remote inspection techniques, whose adoption in the form of drones and other smart devices (exploration robots, remote-controlled vehicles, etc.) is a real advancement. They improve safety by avoiding inspectors having to access hazardous areas, and also increases inspection accuracy;

- ●predictive models, which represent the future of maintenance. Optimized, predictive inspection schemes enable maintenance decisions to be based on specific, dedicated risk analyses. The “BV Machinery Maintenance” solution is an example of how technology can improve maintenance processes in real time, saving time and money;

- ●costs associated with inspections, including for example travel, can be considerably reduced thanks to remote and augmented reality inspections. This means they can be carried out in a safer, more flexible and effective manner.

Intelligent navigation is a driver of decarbonization in the shipping industry

The introduction of smart functions on-board ships enables better supervision and transparency, key drivers in the transition to a more sustainable shipping industry. Through reduced emissions and improved maintenance, smart ships will help facilitate compliance with international regulations and reduce operating costs.

Classification societies play an important role in facilitating the transition to smart shipping, by helping industry players adopt new data-driven processes.

Through its SMART ratings, Bureau Veritas recognizes the importance of this transition and strives to help its clients on their path towards safer, more connected and more environmentally friendly navigation.

The Group is aware of the need for its clients to be able to access durable digital platforms to guide them through their decarbonization and digitalization strategies over the long term. This is what prompted the collaboration between Bureau Veritas and OrbitMI, a maritime software company whose integration platform provides connected information. This technology facilitates effective decision-making by offering a range of simple digital solutions for collecting, reporting and tracking data during maritime operations.

Partnering with our clients beyond the regulatory and compliance field

Developing strong value-added services remains an important growth driver for the Group and its businesses.

Bureau Veritas Solutions Marine & Offshore (BV Solutions M&O) is a separate and independent organization providing clients with specialist technical advice. In this era of energy transition, many players in the shipping industry are looking for solutions to design and operate in a more sustainable way. As an independent consultant, BV Solutions M&O offers engineering and modeling services that enable clients to evaluate and compare various solutions. This entity’s international expansion, most recently in Australia and South Korea, is a response to the growing demand for these types of services.

Particularly in demand are risk and feasibility studies relating to the integration of new fuels such as hydrogen, ammonia and methanol, as well as vessel propulsion systems. These energy alternatives are at the heart of current debates on decarbonizing the shipping industry. In developing expert technical services focused on GHG strategy studies for a variety of stakeholders – from ship owners to banks – BV Solutions M&O uses a global fleet management approach and various management scenarios. These issues are crucial to the industry’s ability to make informed decisions.

-

1.6Accreditations, approvals and authorizations

To conduct its business, the Group has numerous Licenses To Operate - LTO (hereafter “Authorizations”), which vary depending on the country or business concerned: accreditations, approvals, delegations of authority, official recognition, certifications or listings. These Authorizations may be issued by national governments, public or private authorities, and national or international organizations, as appropriate.

Marine & Offshore (M&O) division

The Group is a certified founding member of the International Association of Classification Societies (IACS), which brings together the 11 largest international classification societies. At European level, Bureau Veritas is a “recognized organization” under the European Regulation on classification societies and a “notified body” under the European Directive on marine equipment. Bureau Veritas currently holds more than 150 delegations of authority on behalf of national maritime authorities.

-

1.7Research and development, innovation, patents and licenses

Bureau Veritas is actively engaged in research and innovation to bolster its market positioning and explore new opportunities. The Group’s major initiatives include:

- ●Technological partnerships: the Group partners with manufacturers and start-ups to jointly develop innovative solutions. These partnerships can result in the implementation of cutting-edge technologies such as artificial intelligence (AI) and blockchain.

- ●Strategic alliances: agreements are signed with various companies focused on specific technologies and segments. In 2023, for example, Bureau Veritas entered into a partnership with a US maritime software company (OrtbiMI) to develop joint digital solutions and facilitate their market launch. The aim is to help shipping companies in their digital transformation and decarbonization efforts.

- ●Cybersecurity: involvement in the work of the European Cyber Security Organisation underlines the importance of this issue, in line with the European Commission’s objectives.

- ●Collaborative projects: involvement in projects funded by institutions such as the Single Interministerial Fund and in European calls for projects underscores the Group’s commitment to large-scale initiatives. Bureau Veritas has joined CLEANHYPRO, for example. This project:

- ●is a consortium of 28 partners from original equipment manufacturers (OEMs) and research and technology organizations,

- ●is co-funded by the European Union, and its primary mission is to spearhead innovation in electrolysis technologies and materials. Bureau Veritas’ remit is to develop a quality label for electrolyzer batteries, offering transparency on technology and product quality. Product quality covers reliability, the effects of aging, efficiency and durability criteria;

- ●Hydrogen and renewable energies: by joining the Hydrogen Council and actively participating in ISO and IEC standardization committees, the Group is demonstrating its intention to support and shape the future of clean energies.

- ●Digitalization: the Group is aware of the need to transition to more digital offerings and is therefore stepping up efforts to develop new concepts such as future inspection/audit services.

- ●Continuous innovation: in light of fast-paced changes in the TIC market, the Group is constantly investing to adapt and meet emerging client needs. Bureau Veritas is resolutely forward-looking, harnessing a proactive approach to research and innovation to stay at the forefront of its industry. Initiatives include:

- ●development of innovative artificial intelligence (AI) for new inspection techniques (shape recognition AI and 3D technologies) and for the use of technical rules and data (natural language-processing AI);

- ●revamp of production tools to form a collaborative digital platform open to clients, leveraging product lifecycle management solutions (partnership with ARAS Innovator);

- ●ongoing development of classification services to support the digitalization of maritime shipments through intelligent ratings, developed together with clients and digital solution suppliers.

-

1.8Information systems

- ●Defining the Group’s technological architecture. The department sets the standards for applications and infrastructure across all businesses and geographical areas;

- ●Selecting and managing integrated solutions for all Group units. These solutions include messaging, collaboration tools and various systems such as ERP finance, client management, Human Resources and production;

- ●Guaranteeing the availability and security of all of the Group’s infrastructures and solutions;

- ●Managing the Group’s overall relationship with its main suppliers of equipment, software, telecommunications and services.

The department is supported by six regional centers: North America, Latin America, Europe, France/Africa, Asia, and the Middle East/Pacific. These centers provide various services to the countries in their respective regions.

A Global Shared Service Center has also been set up in India to pool certain support processes. In 2023, operating expenses and running costs for the Group’s information systems represented 4% of the Group’s revenue.

1)After the June 2013 four-for-one stock split.2)At February 29, 2024.3)TAR: Number of accidents with and without lost time x 200,000/Number of hours worked.4)Proportion of women on the Executive Committee in Band III (internal grade corresponding to a management position) in the Group (number of full-time equivalent women occupying a management position/total number of full-time equivalents occupying a management position).5)Compound Average Growth Rate.6)At constant currency.7)(Net cash generated from operating activities – lease payments + corporate tax)/adjusted operating profit. -

Non-Financial

Statement

(NFS)2.1General information

Details on Bureau Veritas’ Non-Financial Statement (NFS) appear in the three following sections of this Universal Registration Document (URD):

- ●chapter 1 presents the Bureau Veritas Group and its business model;

- ●chapter 2, which describes the Group’s sustainability policies, is also known as the Sustainability Report;

- ●chapter 4 presents risk management.

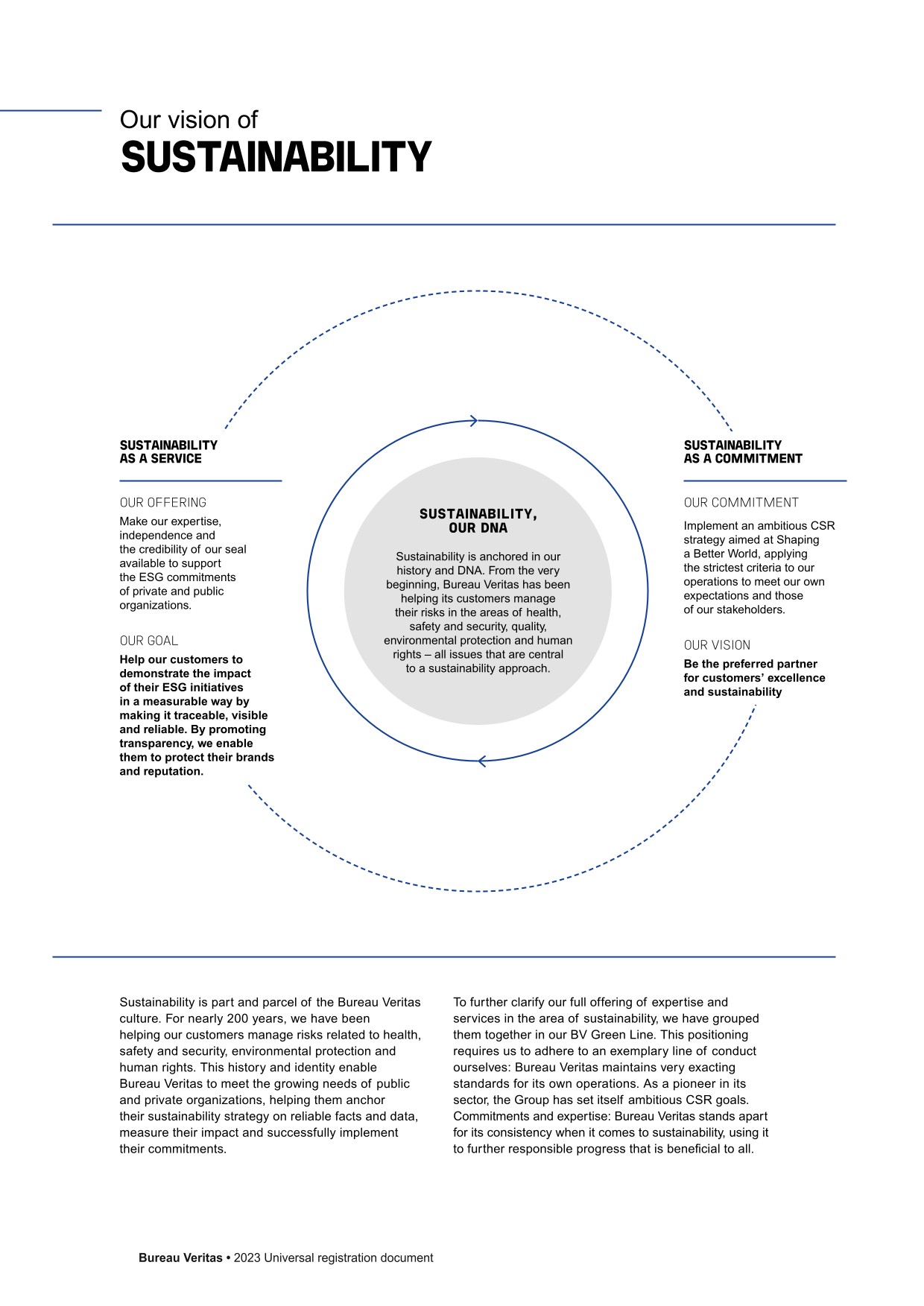

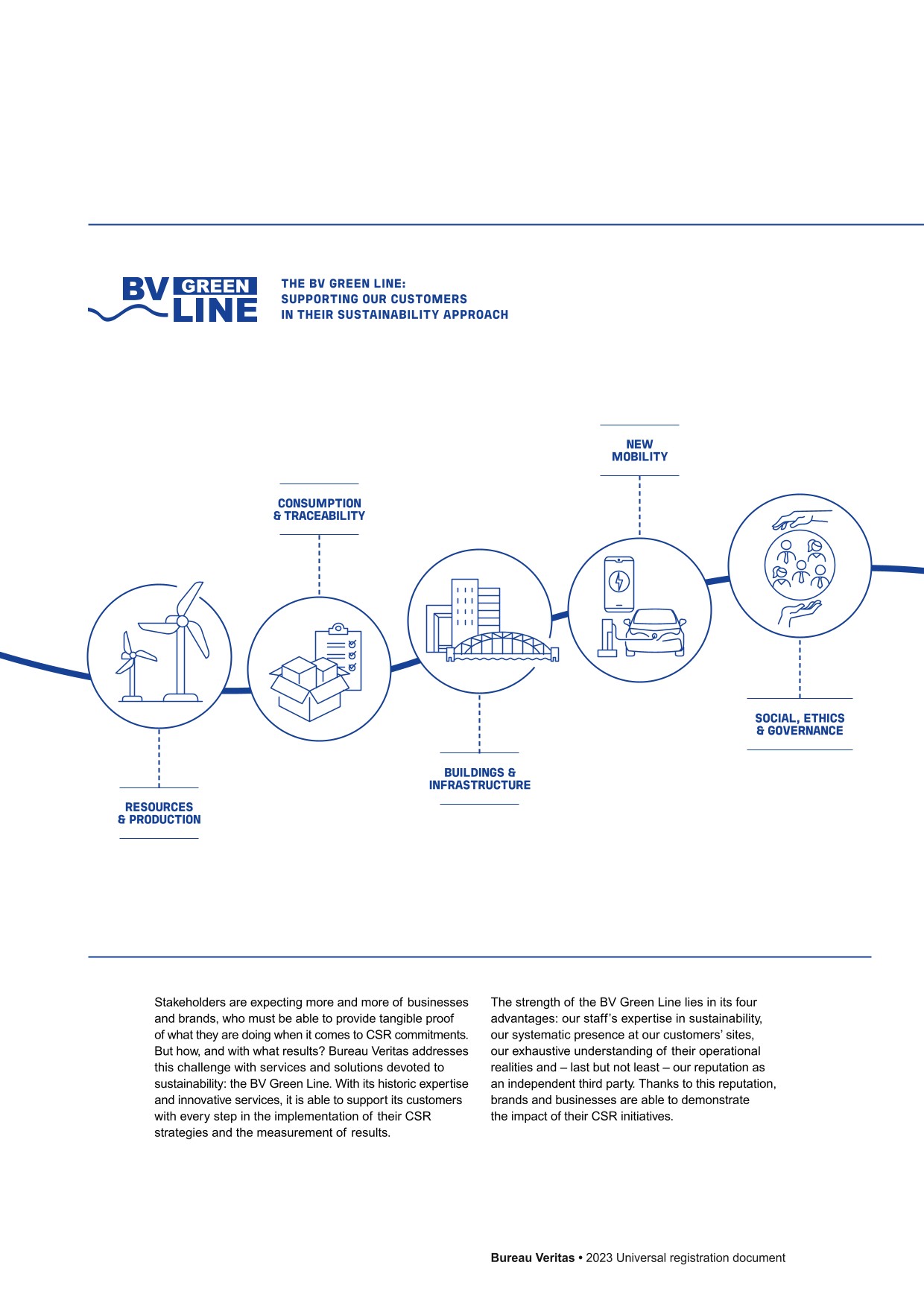

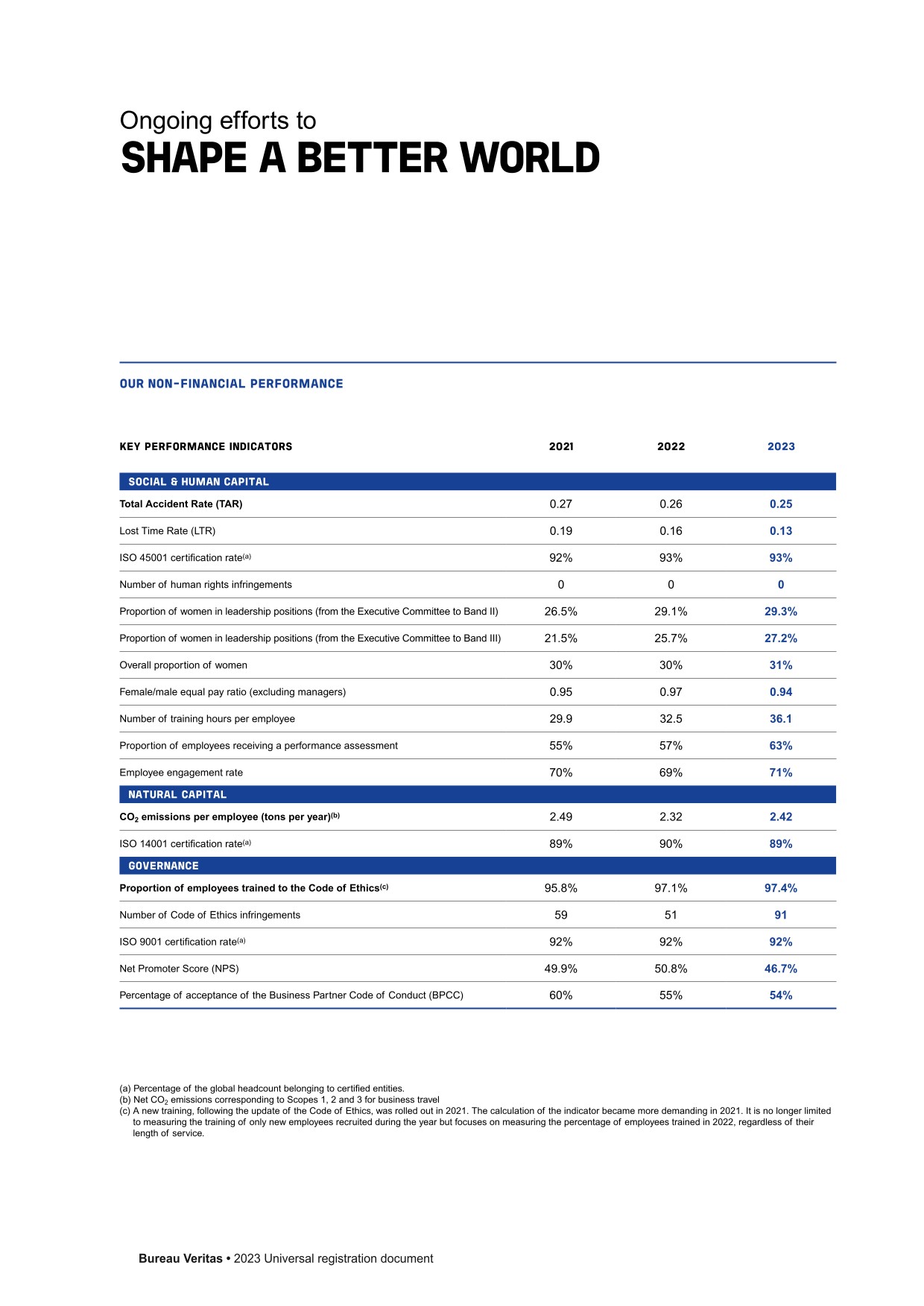

Since 1828, Bureau Veritas has acted as trust maker between companies, governments and society. It is an independent, impartial guarantor of its clients’ word.

Identity

Bureau Veritas is a world leader in laboratory testing, inspection and certification services. Created in 1828, the Group has approximately 82,000 employees located in more than 1,600 offices and laboratories across the globe. Bureau Veritas helps its clients improve their performance by offering services and innovative solutions in order to ensure that their assets, products, infrastructure and processes meet standards and regulations in terms of quality, health and safety, environmental protection and social responsibility.

Bureau Veritas is a Business to Business to Society service company that contributes to positively transforming the world we live in. We work closely with our clients to address the critical challenges they face and to link these to the emerging aspirations of society. We work with companies to build and protect their reputations, supporting them as they forge the foundations of trust that are built to last.

-

2.2Environmental information

2.2.1Taxonomy

This Taxonomy reporting complies with Regulation (EU) No. 2020/852 of the European Parliament and of the Council of June 18, 2020 on the establishment of a framework to facilitate sustainable investment, and with Delegated Regulation (EU) No. 2021/2178 of the Commission of July 6, 2021, amended by the Delegated Regulation (EU) 2023/2486 of June 27, 2023, specifying the content and presentation of information to be disclosed.

2.2.1.1Background

The Taxonomy regulation aims to direct funding to activities that significantly contribute to one or more of the Taxonomy’s six following environmental objectives:

- ●climate change mitigation;

- ●climate change adaptation;

- ●sustainable use and protection of water and marine resources;

- ●transition to a circular economy;

- ●prevention and reduction of pollution;

- ●protection and restoration of biodiversity and ecosystems.

Delegated acts set the technical review criteria for determining the conditions under which an economic activity may claim to make a substantial contribution to one or more of the objectives of the Regulation, and for determining whether it does any significant harm to any of the other environmental objectives.

- ●they make a substantial contribution to at least one of the six environmental objectives;

- ●they do no significant harm to any of the other environmental objectives;

- ●they comply with minimum social safeguards; and

- ●they comply with the technical screening criteria set by the European Commission.

2.2.1.2Reporting methodology

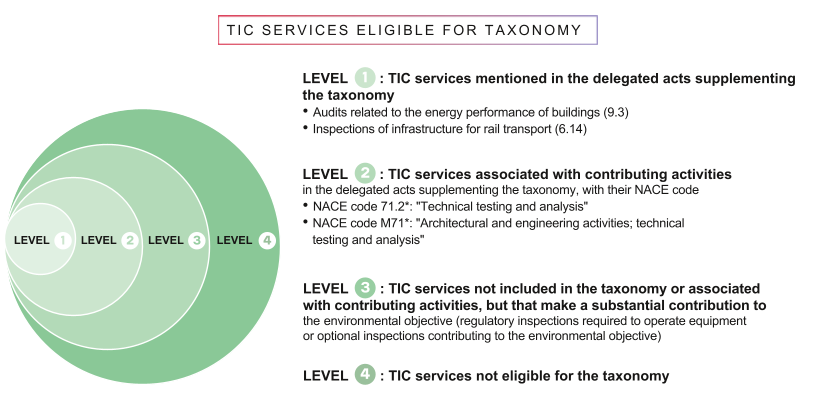

TIC Council, the professional association of compliance verification bodies, has published a guide on Taxonomy reporting for the TIC (testing, inspection, certification) sector. This guide specifies which services are Taxonomy-eligible. It was updated in 2023 to cover all six environmental objectives.

- ●services eligible for the Taxonomy:

- ●Level 1: TIC services explicitly mentioned in the delegated acts of the Taxonomy;

- ●services not eligible for the Taxonomy:

- ●Level 2: TIC services implicitly included in Taxonomy-eligible activities;

- ●Level 3: Other TIC services contributing substantially to one or more environmental objectives;

- ●Level 4: TIC services that do not contribute to environmental objectives.

Eligible services

Ref. Economic activity

Economic activity

Eligible TIC Services

CCA 6.14

Infrastructure for rail transport

Services delivered to electric rail infrastructure:

- ●Regulatory technical control and safety inspections;

- ●Project management and asset management;

- ●Rail component and structure tests.

CCA 6.15

Infrastructure enabling road transport and public transport

Services related to road and public transport:

- ●Regulatory technical control and safety inspections;

- ●Project management and asset management;

- ●Material, component and structure tests.

CCM 6.14

Infrastructure for rail transport

Services delivered to electric rail infrastructure:

- ●Regulatory technical control and safety inspections;

- ●Project management and asset management;

- ●Rail component and structure tests.

CCM 6.15

Infrastructure enabling low-carbon road transport and public transport

- ●Electrical vehicle charging station (EVCS) inspections. Electrical urban transport infrastructure control and PMA; Hydrogen fueling station inspections.

CCM 7.3

Installation, maintenance, and repair of energy efficiency equipment

- ●HVAC installation/equipment periodical inspections;

- ●Technical control of energy efficiency works;

- ●Refrigerant fluid expert certification.

CCM 7.6

Installation, maintenance, and repair of renewable energy technologies

- ●Control and inspection of wind, hot water and photovoltaic solar projects.

CCM 9.3

Professional services related to energy performance of buildings

- ●Assessment of building energy performance.

CE 3.2

Renovation of existing buildings

- ●Structural diagnosis – Asbestos inspections;

- ●Waste categorization – Safety plans.

PPC 2.4

Remediation of contaminated sites and area

- ●Environmental testing.

CCA: climate change adaptation

CCM: climate change mitigation

CE: circular economy

PPC: pollution prevention and control

WTR: water and marine resources

2.2.1.3Bureau Veritas 2023 reporting

The Taxonomy reporting is prepared by a Committee spanning the Finance, Operations, Systems and CSR functions. The Committee reviews and validates the reporting method used and verifies the data collected.

Bureau Veritas’ reporting complies with the recommendations of the Taxonomy Reporting Guide issued by TIC Council, the professional association of compliance auditors.

- ●the 2023 report covers the proportion of turnover, capital expenditure (Capex) and operating expenditure (Opex) associated with eligible/not-eligible and aligned/non-aligned activities;

- ●activities that would be eligible under both climate change mitigation and climate change adaptation are reported only under climate change mitigation, to avoid any risk of being counted twice;

- ●eligibility: only level 1 activities are reported as eligible;

- ●alignment:

- ●SC (substantial contribution):

- ●SC criteria are met for the activities with which TIC services are associated,

- ●because of the difficulties involved in collecting SC data owing to the large number of clients concerned; only activities without SC criteria are considered aligned in this report;

- ●DNSH (do no significant harm):

- ●none of the reported activities do any significant harm to the other environmental objectives (Article 17 of the Taxonomy Regulation),

- ●the DNSH requirements for the activities with which TIC services are associated apply only when relevant, as recommended in the European Commission FAQ of December 19, 2022,

- ●the DNSH requirements listed in Annex A (“Generic criteria for DNSH to climate change mitigation”) of the Delegated Act for Climate Change Mitigation apply;

- ●Minimum safeguards:

- ●the minimum safeguards fall into four categories;

- ●human rights

- Bureau Veritas’ Human Rights Policy and the Duty of Care Report ensure that Bureau Veritas respects human rights in its operations, subsidiaries and value chain (see sections 2.3.1.2-B-m – Human rights and 2.4.4 – Duty of Care Plan, of this Universal Registration Document),

- ●corruption

- Bureau Veritas’ Code of Ethics, which undergoes regular internal and external audits, ensures that Bureau Veritas complies with anti-corruption expectations (see section 2.4.1 – Business conduct, of this Universal Registration Document),

- ●tax

- Bureau Veritas ensures that its businesses comply with laws and regulations on tax evasion, and strives to conduct its business in strict compliance with applicable tax regulations (see section 2.1.2.5 – Tax evasion, of this Universal Registration Document),

- ●fair competition

- Compliance with fair competition practices is covered by Bureau Veritas’ Code of Ethics, which undergoes regular internal and external audits (see section 2.4.1 – Business conduct, of this Universal Registration Document);

- ●human rights

- ●Bureau Veritas conducts its business in accordance with the OECD Guidelines for Multinational Enterprises and the UN Guiding Principles on Business and Human Rights, including the principles and rights set out in the eight core conventions cited in the International Labor Organization’s Declaration on Fundamental Principles and Rights at Work and the International Bill of Human Rights (Article 18 of the Taxonomy Regulation). See sections 2.1.3.1 − Strategy, business model and value chain, 2.4.1 – Business conduct and 2.3.1.2-B-m – Human rights, of this Universal Registration Document,

- ●no criminal conviction.

- ●the minimum safeguards fall into four categories;

- ●SC (substantial contribution):

This report is presented according to the requirements of Annex 8 of the EU Taxonomy Regulation and Delegated Regulation (EU) No. 2020/852 of the Commission.

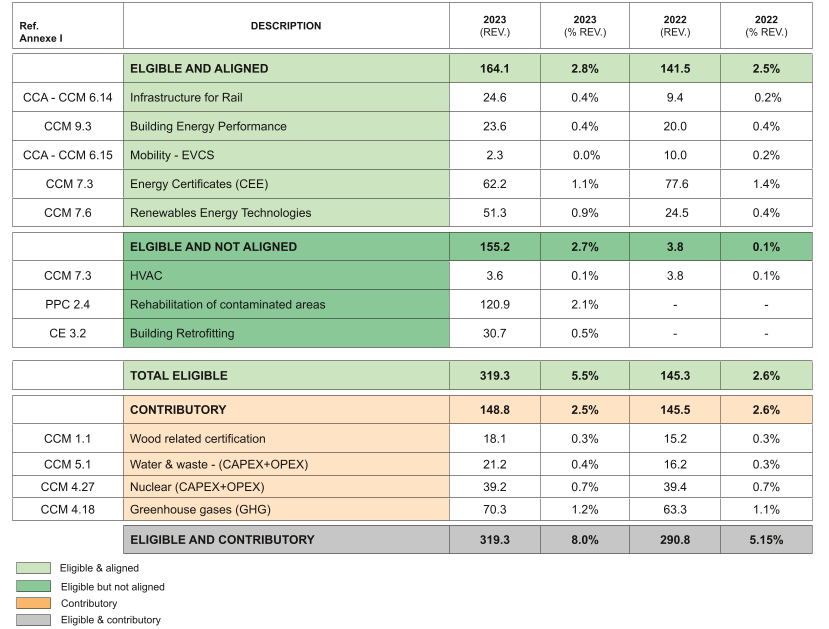

Turnover

- ●turnover is taken from the Group’s management tool (FLEX), for traceability of the amounts declared. The eligibility of each case is examined through criteria defined for three attributes: 1/ the nature of the service, 2/ the client’s market, and 3/ the object on which the service is provided;

- ●the eligibility and alignment criteria used are those defined in the TIC Council 2023 Guidelines.

Taxonomy-eligible and -aligned Turnover by environmental objective

Share of total, eligible and aligned Turnover

Proportion of total Turnover

- ●the 2023 Taxonomy reporting covers all six environmental objectives presented in 2.2.1.1 – Background, of this Universal Registration Document. This scope differs from the 2022 reporting, which only covered the climate change mitigation and adaptation of environmental objectives.

- ●The Taxonomy reporting coverage rate is 80%; it was 57% in 2022. This rate corresponds to the proportion of Bureau Veritas’ Turnover that has the three attributes necessary to be analyzed with regard to the Taxonomy eligibility criteria in the Group’s ERP. Thus, in 2023, 20% of Bureau Veritas’ Turnover could not be analyzed and the corresponding activities were deemed ineligible, in accordance with a Note from the Commission that prohibits extrapolation. Taxonomy-eligible Turnover is therefore underestimated in 2023.

Capex

In 2023, capital expenditure related to assets or processes associated with economic activities that could be considered environmentally sustainable under Annexes I and II of the Taxonomy regulation include:

- ●office, laboratory and vehicle leases (IFRS 16):

- ●amount of office and laboratory leases signed in 2023;

- ●company vehicle leases signed in 2023.

Capex breakdown

Capex

2023 amount

(in €m)%

2022 amount

(in €m)%

Office or laboratory leases

95.4

29%

92.2

29%

Equipment and company vehicle leases

49.9

15%

41.2

13%

Total eligible Capex (numerator)

145.3

44%

133.4

42%

Property, plant and equipment (land, buildings or equipment)

132.9

41%

109.7

35%

Intangible assets (software, patents, etc.)

48.9

15%

73.0

23%

Total Capex (denominator)

327.1

100%

316.1

100%

Capex is made available to Bureau Veritas businesses indiscriminately. Office and laboratory leases have been classified in category 7.7 (Acquisition and ownership of buildings) of Annex I. Leases of company vehicles have been classified in category 6.5 (Transport by motorbikes, passenger cars and light commercial vehicles). As we do not have the means to quantify the proportion of aligned Capex, Bureau Veritas considers that all of this Capex is non-aligned.

Opex

Opex encompasses operating expenditure related to assets or processes associated with economic activities that could be considered environmentally sustainable, including the following:

- ●research and development for €4.9 million;

- ●short-term leases for €51.5 million;

- ●maintenance and repair of assets for €114.8 million.

Opex breakdown

This operational expenditure accounts for less than 5% of operational costs (salaries, sub-contractors and purchasing). It is not material for Bureau Veritas business model. Consequently, it will not be reported according to the exemption rule set out in article 1.3.1.2 of Commission delegated regulation (EU) 2021/2178 of July 6, 2021.

(in €m)

Salaries (a)

Sub-

contractors (b)Purchasing (c)

Op. Costs

(a)+(b)+(c)Opex/Op.

costs (%)2023 Operational costs (Op. Costs)

2,533

613

1,029

4,175

1.4%

Turnover

Year N

2023

Substantial contribution criteria

DNSH criteria ("Does No Significant Harm”) (h)

Economic activities (1)

Code(s) (2)

Turnover (3)

Proportion of turnover, year N (4)

Climate change

mitigation (5)Climate change

adaptation (6)Water (7)

Pollution (8)

Circular economy (9)

Biodiversity (10)

Climate change

mitigation (11)Climate change

adaptation (12)Water (13)

Pollution (14)

Circular economy (15)

Biodiversity (16)

Minimum safeguards

(17)Proportion of

taxonomy-aligned (A.1)

or taxonomy-eligible

(A.2) turnover, year N-1

(18)Category (enabling

activity) year N-1 (19)Category (transitional

activity) (20)(€M)

%

YES; NO; N/EL

YES; NO; N/EL

YES; NO; N/EL

YES; NO; N/EL

YES; NO; N/EL

YES; NO; N/EL

YES/NO

YES/NO

YES/NO

YES/NO

YES/NO

YES/NO

YES/NO

%

M

T

A – Taxonomy-eligible activities

A.1. Environmentally sustainable activities (Taxonomy-aligned)

Infrastructure for rail transport (Annex I-6.14)

Technical control and inspection of rail transport infrastructure

CCM 6.14

24.6

0.4%

YES

NO

NO

NO

NO

NO

YES

YES

YES

YES

YES

YES

YES

0.2%

M

Professional services related to energy performance of buildings (Annex I-9.3)

Audits of building energy performance

CCM 9.3

23.6

0.4%

YES

NO

NO

NO

NO

NO

YES

YES

YES

YES

YES

YES

YES

0.4%

M

Infrastructure enabling low-carbon road transport and public transport (Annex I-6.15)

Inspection of electric vehicle charging stations

CCM 6.15

2.3

0.0%

YES

NO

NO

NO

NO

NO

YES

YES

YES

YES

YES

YES

YES

0.2%

M

Installation, maintenance and repair of energy efficiency equipment (Annex I-7.3)

Issuance of energy saving certificates

CCM 7.3

62.2

1.1%

YES

NO

NO

NO

NO

NO

YES

YES

YES

YES

YES

YES

YES

1.4%

M

Installation, maintenance, and repair of renewable energy technologies (Annex I-7.6)

Inspection of renewable energy production facilities

CCM 7.6

51.3

0.9%

YES

NO

NO

NO

NO

NO

YES

YES

YES

YES

YES

YES

YES

0.4%

M

Turnover of environmentally sustainable activities (Taxonomy-aligned) (A.1)

164

2.8%

2.8%

0%

0%

0%

0%

0%

YES

YES

YES

YES

YES

YES

YES

2.5%

o/w enabling

164

2.8%

2.8%

0%

0%

0%

0%

0%

YES

YES

YES

YES

YES

YES

YES

2.5%

M

o/w transitional

0

0%

YES

YES

YES

YES

YES

YES

YES

0%

T

A.2. Taxonomy-eligible but not environmentally sustainable activities (not Taxonomy-aligned) (g)

EL; N/EL (f)

EL; N/EL (f)

EL; N/EL (f)

EL; N/EL (f)

EL; N/EL (f)

EL; N/EL (f)

Installation, maintenance and repair of energy efficiency equipment (Annex I-7.3)

Inspection of heating, ventilation and air conditioning equipment

CCM 7.3

3.6

0.1%

EL

N/EL

N/EL

N/EL

N/EL

N/EL

0.10%

Remediation of contaminated sites and areas (Annex III-2.4)

Environmental testing

PPC 2.4

120.9

2.1%

N/EL

N/EL

N/EL

EL

N/EL

N/EL

0%

Renovation of existing buildings (Annex II-3.2)

Renovation of buildings

CE 3.2

30.7

0.5%

N/EL

N/EL

N/EL

N/EL

EL

N/EL

0%

Turnover of Taxonomy-eligible but

not environmentally sustainable activities

(not Taxonomy-aligned) (A.1)155.2

2.6%

0.1%

0%

0%

2.1%

0.5%

0%

0.1%

Taxonomy-eligible turnover (A.1 + A.2)

319.2

5.4%

2.9%

0.0%

0.0%

2.1%

0.5%

0.0%

2.6%

B – Taxonomy-non-eligible activities

Taxonomy non-eligible turnover

5,549

94.6%

Total (A + B)

5,868

100%

Capex

Year N

2023

Substantial contribution criteria

DNSH criteria (‘Does No Significant Harm”) (h)

Economic activities (1)

Code(s) (2)

Capex (3)

Proportion of Capex,

year N (4)Climate change

mitigation (5)Climate change

adaptation (6)Water (7)

Pollution (8)

Circular economy (9)

Biodiversity (10)

Climate change

mitigation (11)Climate change

adaptation (12)Water (13)

Pollution (14)

Circular economy (15)

Biodiversity (16)

Minimum safeguards

(17)Proportion of

taxonomy-aligned (A.1)

or taxonomy-eligible

(A.2) capex, year N-1

(18)Category (enabling

activity) year N-1 (19)Category (transitional

activity) (20)€M

%

YES; NO; N/EL

YES; NO; N/EL

YES; NO; N/EL

YES; NO; N/EL

YES; NO; N/EL

YES; NO; N/EL

YES/NO

YES/NO

YES/NO

YES/NO

YES/NO

YES/NO

YES/NO

%

M

T

A – Taxonomy-eligible activities

A.1. Environmentally sustainable activities (Taxonomy-aligned)

Infrastructure for rail transport (Annex I-6.14)

Technical control and inspection of rail transport infrastructure

CCM 6.14

0

0%

YES

NO

NO

NO

NO

NO

YES

YES

YES

YES

YES

YES

YES

0%

M

Professional services related to energy performance of buildings (Annex I-9.3)

Audits of building energy performance

CCM 9.3

0

0%

YES

NO

NO

NO

NO

NO

YES

YES

YES

YES

YES

YES

YES

0%

M

Infrastructure enabling low-carbon road transport and public transport (Annex I-6.15)

Inspection of electric vehicle charging stations

CCM 6.15

0

0%

YES

NO

NO

NO

NO

NO

YES

YES

YES

YES

YES

YES

YES

0%

M

Installation, maintenance and repair of energy efficiency equipment (Annex I-7.3)

Issuance of energy saving certificates

CCM 7.3

0

0%

YES

NO

NO

NO

NO

NO

YES

YES

YES

YES

YES

YES

YES

0%

M

Installation, maintenance, and repair of renewable energy technologies (Annex I-7.6)

Inspection of renewable energy production facilities

CCM 7.6

0

0%

YES

NO

NO

NO

NO

NO

YES

YES

YES

YES

YES

YES

YES

0%

M

Capex of environmentally sustainable activities (Taxonomy-aligned) (A.1)

0

0%

0.0%

0%

0%

0%

0%

0%

YES

YES

YES

YES

YES

YES

YES

0%

o/w enabling

0

0%

0.0%

0%

0%

0%

0%

0%

YES

YES

YES

YES

YES

YES

YES

0%

M

o/w transitional

0

0%

YES

YES

YES

YES

YES

YES

YES

0%

T

A.2. Taxonomy-eligible but not environmentally sustainable activities (not Taxonomy-aligned) (g)

EL; N/EL (f)

EL; N/EL (f)

EL; N/EL (f)

EL; N/EL (f)

EL; N/EL (f)

EL; N/EL (f)

Installation, maintenance and repair of energy efficiency equipment (Annex I-7.3)

Inspection of heating, ventilation and air conditioning equipment

CCM 7.3

0

0.0%

EL

N/EL

N/EL

N/EL

N/EL

N/EL

0%

Remediation of contaminated sites and areas (Annex III-2.4)

Environmental tests

PPC 2.4

49.9

15.3%

N/EL

N/EL

N/EL

EL

N/EL

N/EL

13%

Renovation of existing buildings (Annex II-3.2)

Renovation of buildings

CE 3.2

95.4

29.2%

N/EL

N/EL

N/EL

N/EL

EL

N/EL

29%

Capex of Taxonomy-eligible but

not environmentally sustainable activities

(not Taxonomy-aligned) (A.1)145.3

44.4%

44.4%

0%

0%

0%

0%

0%

42.2%

Taxonomy-eligible Capex (A.1 + A.2)

145.3

44.4%

44.4%

0%

0%

0%

0%

0%

42.2%

B – Taxonomy-non-eligible activities

Taxonomy non-eligible capex

181.8

55.6%

Total (A + B)

327.1

100%

Opex

Year N

2023

Substantial contribution criteria

DNSH criteria (‘Does No Significant Harm”) (h)

Economic activities (1)

Code(s) (2)

Opex (3)

Proportion of Opex,

year N (4)Climate change

mitigation (5)Climate change

adaptation (6)Water (7)

Pollution (8)

Circular economy (9)

Biodiversity (10)

Climate change

mitigation (11)Climate change

adaptation (12)Water (13)

Pollution (14)

Circular economy (15)

Biodiversity (16)

Minimum safeguards

(17)Proportion of

taxonomy-aligned (A.1)

or taxonomy-eligible

(A.2) Opex, year N-1

(18)Category (enabling

activity) year N-1 (19)Category (transitional activity) (20)

€M

%

YES; NO; N/EL

YES; NO; N/EL

YES; NO; N/EL

YES; NO; N/EL

YES; NO; N/EL

YES; NO; N/EL

YES/NO

YES/NO

YES/NO

YES/NO

YES/NO

YES/NO

YES/NO

%

M

T

A – Taxonomy-eligible activities

A.1. Environmentally sustainable activities (Taxonomy-aligned)

Infrastructure for rail transport (Annex I-6.14)

Technical control and inspection of rail transport infrastructure

CCM 6.14

0

0%

YES

NO

NO

NO

NO

NO

YES

YES

YES

YES

YES

YES

YES

0%

M

Professional services related to energy efficiency of buildings (Annex I-9.3)

Audits of building energy performance

CCM 9.3

0

0%

YES

NO

NO

NO

NO

NO

YES

YES

YES

YES

YES

YES

YES

0%

M

Infrastructure enabling low-carbon road transport and public transport (Annex I-6.15)

Inspection of electric vehicle charging stations

CCM 6.15

0

0%

YES

NO

NO

NO

NO

NO

YES

YES

YES

YES

YES

YES

YES

0%

M

Installation, maintenance and repair of energy efficiency equipment (Annex I-7.3)

Issuance of energy saving certificates

CCM 7.3

0

0%

YES

NO

NO

NO

NO

NO

YES

YES

YES

YES

YES

YES

YES

0%

M

Installation, maintenance, and repair of renewable energy technologies (Annex I-7.6)

Inspection of renewable energy production facilities

CCM 7.6

0

0%

YES

NO

NO

NO

NO

NO

YES

YES

YES

YES

YES

YES

YES

0%

M

Opex of environmentally sustainable activities (Taxonomy-aligned) (A.1)

0

0%

0%

0%

0%

0%

0%

0%

YES

YES

YES

YES

YES

YES

YES

0%

o/w enabling

0

0%

0%

0%

0%

0%

0%

0%

YES

YES

YES

YES

YES

YES

YES

0%

M

o/w transitional

0

0%

YES

YES

YES

YES

YES

YES

YES

0%

T

A.2. Taxonomy-eligible but not environmentally sustainable activities (not Taxonomy-aligned) (g)

EL; N/EL (f)

EL; N/EL (f)

EL; N/EL (f)

EL; N/EL (f)

EL; N/EL (f)

EL; N/EL (f)

Installation, maintenance and repair of energy efficiency equipment (Annex I-7.3)

Inspection of heating, ventilation and air conditioning equipment

CCM 7.3

0

0%

EL

N/EL

N/EL

0%

Remediation of contaminated sites and areas (Annex III-2.4)

Environmental tests

PPC 2.4

0

0%

N/EL

N/EL

N/EL

0%

Renovation of existing buildings (Annex II-3.2)

Renovation of buildings

CE 3.2

0

0%

N/EL

N/EL

N/EL

0%

Opex of Taxonomy-eligible but

not environmentally sustainable activities

(not Taxonomy-aligned) (A.1)0

0%

0%

0%

0%

0%

0%

Taxonomy-eligible Opex (A.1 + A.2)

0

0%

0%

0%

0%

0%

0%

B – Taxonomy-non-eligible activities

Taxonomy non-eligible Opex

56.4

0%

Total (A + B)

56.4

0%

-

2.3Labor-related information

2.3.1Own workforce

2.3.1.1Strategy

Interests and views of stakeholders

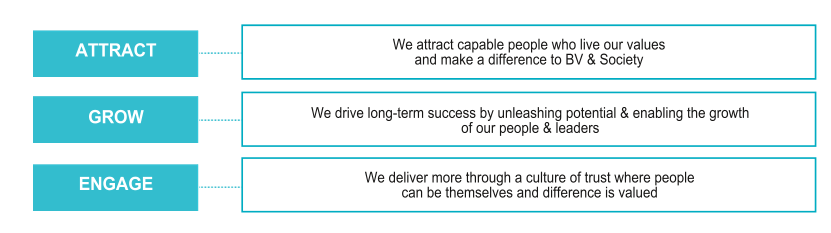

The interests, views and rights of the Group’s stakeholders inform the strategy and business model of Bureau Veritas through a number of priorities. These priorities help achieve a workforce for the Group that can meet the growth objectives through the creation of innovative solutions, the provision of expert advice and knowledge and the uncompromising application of ethical standards in the delivery of services to the Group’s customers. These priorities are also reflected in the Group’s human resources strategy and inform the three key components of this strategy: attract, engage, and grow.

The three components of the Group’s human resources strategy ensure the execution of the strategy through policies, processes, systems and initiatives, which reflect the interests, views and rights of the Group’s workforce. It includes:

- ●the provision of secure and sustainable employment;

- ●creating a diverse workforce and inclusive culture;

- ●on-going training and career development;

- ●highly engaged members of the workforce;

- ●a safe workplace;

- ●the respect of human rights, including labor rights.

Material impacts, risks and opportunities and their interaction with strategy and business model

Actual and potential material impacts, risks and opportunities related to the Group’s workforce

Challenges

for Bureau VeritasImpacts

for stakeholdersFinancial risks

for Bureau VeritasFinancial opportunities

for Bureau Veritas- ●Ensure equitable treatment and opportunities for all

- ●Adapt working conditions for employee work-life balance and career evolving expectations

- ●Achieve gender balance in a traditionally male, technical environment

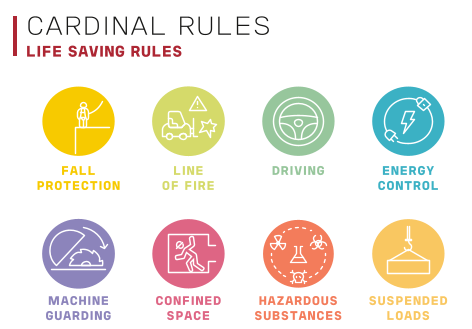

- ●Provide appropriate health & safety conditions to the workforce considering it is often exposed to safety conditions at clients’ sites

- ●Develop skills and learning to adapt to the most recent technologies, regulations and client needs

- ●Manage and align the non-employee workforce with the Group policies and processes

- ●Maintain a competitive wage policy

Risk of negative impacts are:

- ●safety accidents at work;

- ●stress at work due to workload;

- ●exposure to corruption or unethical behaviors;

- ●non-respect of human rights principles;

- ●lack of engagement.

Positive impacts are:

- ●ensuring equitable treatment for women and men;

- ●work-life balance for workers;

- ●establishment of a diverse and inclusive working environment;

- ●processes for safe working conditions reducing accident and illness;

- ●personal development of employees and access to new career opportunities;

- ●providing non-employees with better work conditions aligned with Bureau Veritas standards.

- ●Reputational risk impacting the ability to attract clients and talent

- ●Risk of social claims arising from employees

- ●Lack of attractiveness of Bureau Veritas and risk of having an unstable workforce

- ●Decreased productivity and commitment of the workforce

- ●Loss of expertise needed to respond to market needs and deliver a high-quality service

- ●Lack of qualified resources to deliver ESG-related services

- ●Reduced recruitment costs

- ●Higher productivity and better quality of service to customers

- ●Enhanced Company brand

- ●Reputation and attractiveness of the Group

- ●More secure and accelerated business growth

- ●More business opportunities in relation to social and sustainability audits

- ●the need for the Group to have a highly skilled workforce to meet the changing needs and expectations of its customers;

- ●the competitive advantage in productivity the Group receives from having a workforce that is highly engaged;

- ●innovation and creativity from the Group’s workforce that it leverages to develop solutions for its customers and its own operations that are enabled through a diverse workforce;

- ●a strong organizational and employer brand the Group utilizes to attract and retain members of its workforce and its customers to meet its growth plans through an inclusive, consultative, and safe culture.

Members of the Group's workforce to whom these impacts, risks, and opportunities primarily relate are its employees and non-employees.

- ●Employees have mainly permanent contracts. Due to the specificity of certain activities, Bureau Veritas also uses fixed term, and non-guaranteed hours employment contracts.

- ●Non-employees of the Group's workforce are not significant in number relative to employees and are not managed centrally. They provide to Bureau Veritas additional capacity when facing a peak of activity and additional expertise for specific technical requirements. These non-employees are mainly sub-contractors participating in the delivery of the Group's services. Regardless of where they provide their services, they do so under the responsibility of Bureau Veritas’ Management, and they apply Bureau Veritas’ policies and processes.

The Group currently does not consolidate central records of these non-employees. For this reason, the information provided in section 2.3.1 − Own workforce, of this Universal Registration Document relates to employees only, unless otherwise stated.

2.3.1.2Impacts, risks and opportunities management

I- Policies & Actions

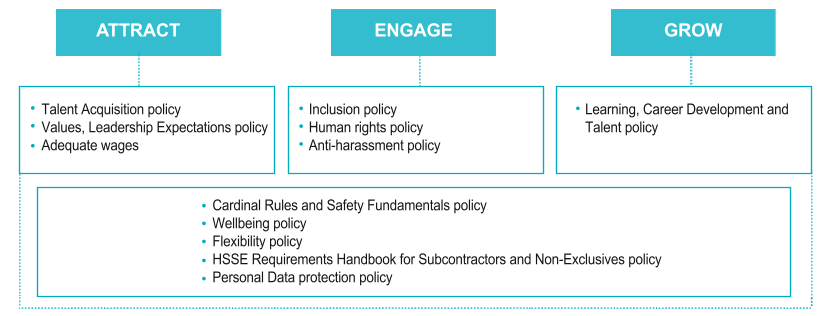

The management of the impacts, risks and opportunities for the workforce of the Group is undertaken through the design and execution of the Group’s human resources strategy. This strategy has three core components, ‘attract’, ‘engage’, and ‘grow’.

Key policies within these three components that manage these impacts, risks, and opportunities include:

A. Attract

a. Strategic Workforce Planning and Employer Branding

In order to provide and maximize secure employment for its workforce, the Group needs to continuously attract qualified and skilled individuals to meet the Group’s operational and growth needs. The Group’s strategic workforce planning uses talent analytics with data sourced from the Group’s talent assessment, development, and succession planning processes. This data helps show the key capabilities and profiles needed to achieve the growth ambitions in Bureau Veritas’ strategy. These capabilities and profiles include:

- ●sales specialists and leaders of sales teams to drive organic growth;

- ●sustainability experts and managers to design and market new services;

- ●digital skills to support the transformation of services offerings;

- ●cybersecurity specialists to offer enhanced cybersecurity reviews and consulting;

- ●change specialists to contribute to enterprise transformation programs;

- ●more diverse talent with a focus on achieving greater balance among managers relative to gender, generation, and nationality.

The above talent analytics insights have influenced the approaches used by talent acquisition teams to recruit new hires, including:

- ●selecting and leveraging talent sourcing platforms;

- ●strengthening partnerships with external talent search providers;

- ●training talent acquisition teams and managers;

- ●enhancing the Group’s employer branding strategy, as a distinctive employer brand that focuses on the opportunities available to people in the workforce of the Group to make concrete and valuable contributions to Bureau Veritas that impact the sustainable growth of the communities where the Group operates. The Group’s employer brand, known as “LEAVE YOUR MARK” will continue to evolve and be enhanced in the future through placing increased emphasis on the opportunity the Group’s people have to make a lasting difference to our communities;

- ●digitalization of talent attraction processes, including leveraging artificial intelligence;

- ●introduction and/or expansion of early careers programs, in France, where the Group recruited 232 students as interns in 2023 and in India, where Bureau Veritas recruited 22 graduate trainees as part of its information technology career program.

The “LEAVE YOUR MARK” employer brand is used in global and local channels to attract talent to the Group in targeted social media, such as LinkedIn, Facebook, Instagram, Twitter, Spotify and Deezer with new “dynamic” job advertisements and new joiner “GIFs”. The brand has also been used in training for recruiters and hiring managers to attract talent, in the Group’s website, in specialist recruitment forums, in sponsoring special events at leading engineering and business schools/universities and in awareness programs for external recruitment partners.

The Group’s employer branding and talent attraction, assessment and selection processes also aim to recruit individuals who consistently display the Group’s values (below) which are expected to be displayed by all employees in everyday actions and words.

b. Decent wages

The Group regularly carries out compensation surveys to ensure that its competitive positioning is maintained, enabling it to attract the right applicants, retain its people, and to compensate employees according to their level of performance for the roles they hold.

Bureau Veritas also has profit-sharing agreements and savings plans, such as in France where all employees participate in profit-sharing based on local labor law. In addition, employees who have worked for the Group for more than three months are entitled to contractual profit-sharing proportional to their seniority. An agreement to convert the Company savings plan into a Group savings plan was signed with the Works Council on July 19, 2007, enabling all Group companies that constitute “related companies” (within the meaning of article L. 3332-15, paragraph 2, of the French Labor Code) to join the Group savings plan. The plan spans seven mutual funds in which €197,738,561 was invested as of December 31, 2023. Bureau Veritas contributes to the savings of its employees by paying a top-up contribution, up to a maximum of €1,525 per employee and per calendar year.

B. Engage

a. Employee feedback

The Group conducts regular surveys to obtain feedback from its employees and then takes action based on the results of these surveys. These surveys include:

- ●an annual employee engagement survey;

- ●onboarding surveys sent to new recruits;

- ●exit surveys sent to employees who are about to leave Bureau Veritas;

- ●special topic surveys, such as on diversity, equity & inclusion.

b. Inclusive Culture and Diverse Workforce

The Group’s commitment to building, through equity, a sustainably diverse workforce with an inclusive culture is illustrated by multiple policies and initiatives, including:

- ●the Bureau Veritas Inclusion Policy, Anti-harassment policy, and Code of Ethics;

- ●one of the four BV Values, “Open & Inclusive” (below), reflects the Group’s belief that employees can only reach their full potential if they are able to express themselves freely and openly and if the actions and behaviors of Bureau Veritas’ employees encourage such expression. Employees are evaluated each year as part of their performance assessment on their effective demonstration of all Bureau Veritas values;

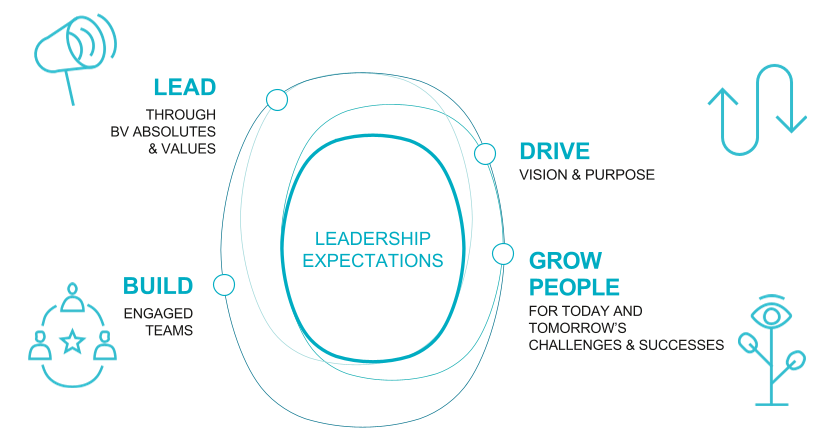

- ●managers are further expected to enhance the Group’s inclusive culture by demonstrating the Leadership Expectations, Two of them specifically target the on-going development of its inclusive culture: “Lead through Bureau Veritas Absolutes and Values” and “Build Engaged Teams”. Managers are evaluated each year as part of their performance assessment on their effective demonstration of all Bureau Veritas Leadership Expectations;

- ●all managers and team leaders are required to complete the “Leading Inclusive Teams@BV” program that includes core learning on: (i) inclusive behaviors to remove unconscious bias; (ii) attracting, assessing, and selecting talent using inclusive words and actions; (iii) preventing harassment and awareness of relevant policies and their application;

- ●learning programs and awareness on special topics, such as women’s health or menopause awareness sessions for employees and managers in the United Kingdom;

- ●membership of associations, such as Association Française des Managers de la Diversité in France, that provide resources to promote diversity and inclusion;

- ●Bureau Veritas is a signatory of the “Charte de la Diversité” in France;

- ●the Group’s Global Inclusion Calendar which is based in part on the United Nation’s International Days and is supplemented by additional local days. The days in the calendar are celebrated by employees and are used as an opportunity to learn how to improve the diversity of the workforce and the Group’s inclusive culture.

c. Gender balance

For Bureau Veritas, achieving greater gender balance is a key business priority for which strategies have and will continue to be implemented to meet the Group’s ambitious gender balance goals. These strategies include:

- ●accelerated leadership development programs for high potential women in all regions of the world, including these examples:

- ●Women in Leadership – Asia Pacific and the Middle East. This program identifies high potential women who, over a six-month period, undertake group and individual assessments and learning on priority topics to accelerate their development in collaboration with Roffey Park Institute. This learning is complemented by individual executive coaching that strengthens participants’ capabilities, as agreed by participants and their coaches and managers,

- ●Women@BV in France. This program is designed to accelerate the development of high potential women and includes mentoring from senior leaders, guest speakers on priority topics, and tools to develop one’s leadership style. It also aims to increase access to the TIC industry for women through partnership with, “Elles bougent”, which includes inviting teenage girls to the Group’s offices to learn about career options, requiring shortlists with at least one woman wherever possible;

- ●all employees in the Group are provided maternity protection from workplace risks as an application of its Cardinal Safety Rules, and maternity protection from dismissal based on local laws and regulations;

- ●extended paid parental leave beyond local law in several countries:

- ●in the United Kingdom, paid maternity and paternity leave exceeds that required by local law: for maternity leave, the first six weeks are paid at 100% (vs. 90% required by law) and weeks seven to 16 are also paid at 100% (vs. 152 GBP per week required by law); for paternity leave, two weeks are paid at 100% (vs. 152 GBP per week required by law),

- ●in Australia, paid parental leave is provided to any employee who is the primary caregiver of a newborn or recently adopted child, once he or she has 12 months’ seniority. Paid leave is six weeks at the employee’s basic rate of pay, with a further two weeks’ pay if the employee returns to the business for at least one month. In addition, employees who are not the primary caregiver can use five days of accrued “personal leave” (sick and career leave) when the child comes home,

- ●in the United States, Bureau Veritas offers parental (maternity) leave benefits providing two-thirds of an employee’s basic salary for a period of up to 13 weeks if there is an underlying medical condition,

- ●in India, parental leave benefits are extended to fathers in the form of five days paid leave,

- ●in Spain, employees are provided childcare contributions in the form of cash allowances in the following situations: the birth or adoption of a child, for children of school age between 6 and 16 years of age, children who have a disability, and “large families”; paid leave: up to five additional paid days beyond the minimum legal requirement of 12 weeks for a mother if she transfers part of her maternity leave to the father;

- ●the offices of Bureau Veritas in a number of countries, including in France and Spain, provide dedicated breast-feeding rooms for women;

- ●Bureau Veritas in the United Kingdom provides awareness and training for employees on menopause in order to provide better support to employees who are experiencing menopause;

- ●in Europe, the Group holds the Gender Equality European and International Standard (GEEIS) certification in three key countries (Spain, Italy and Poland) after examination of the relevant criteria, including ensuring specific people policies and practices were in place;

- ●Bureau Veritas is a signatory of the United Nations Women’s Empowerment Principles in order to reinforce its commitment, and support its strategies, to advance gender equality and women’s empowerment in the workplace and more broadly within society;

- ●the Group’s Chief Executive Officer, Hinda Gharbi, is an Executive Interviewer for the "WeQual Awards” which identify and showcase world-class executive women, ready for progressing to Group Executive Committee positions. Hinda Gharbi is also a mentor as part of the mentoring program of “Observatoire de la Mixité”. Additionally, Hinda Gharbi is a mentor as part of the new organization “Equaleaders” whose purpose is to promote greater gender balance in governing bodies in France;

- ●Bureau Veritas’ Executive Vice-President, Marine & Offshore, Matthieu Gondallier de Tugny, is a founding member of the Global Maritime Forum’s Diversity Study Council whose mission is to develop a Global Charter for Diversity & Inclusion for the maritime industry with the objective of enabling women’s access to, and advancement within, the maritime industry;

- ●the Group’s Vice-President Sales & Marketing – France & Africa, Nathalie Brunel, is a member of the board of the association “Elles bougent” which aims to attract more women to pursue careers in engineering.

d. Creating a racially and ethnically diverse company

- ●The Group is also very committed to enhancing the ethnic and racial diversity of its workforce, and to ensuring its workplace culture enables all people, regardless of their ethnicity and race to thrive. Bureau Veritas operates in 140 countries with 159 nationalities represented among its employees. The Bureau Veritas values, leadership expectations, and Group policies all support the commitment to improve Bureau Veritas’ ethnic and racial diversity, which apply at all levels, including the most senior leadership roles. For example, the Group Executive Committee includes a range of nationalities (Australian/Tunisian, Brazilian, British, Chinese, Canadian/USA, French and Peruvian), with 42% of members having non-European nationality.

- ●The Group continues to increase the capacity of individual managers to create a workforce of diverse ethnicity and race, and a workplace culture where everyone has equal opportunities to succeed and progress their careers. Initiatives taken to support this include:

- ●training programs on inclusive leadership and effective interviewing,

- ●evaluation of managers’ demonstration of the BV Values and Leadership Expectations,

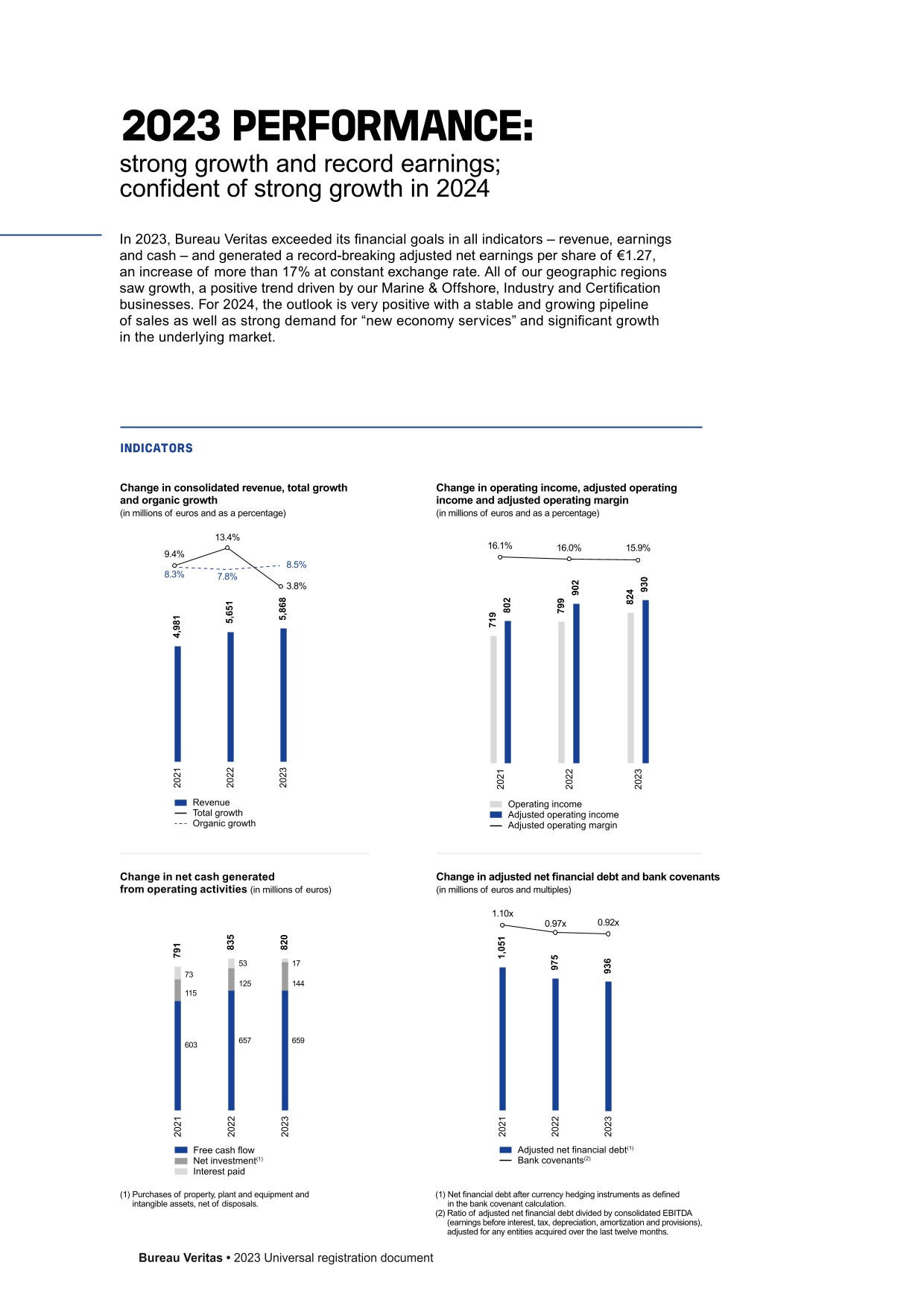

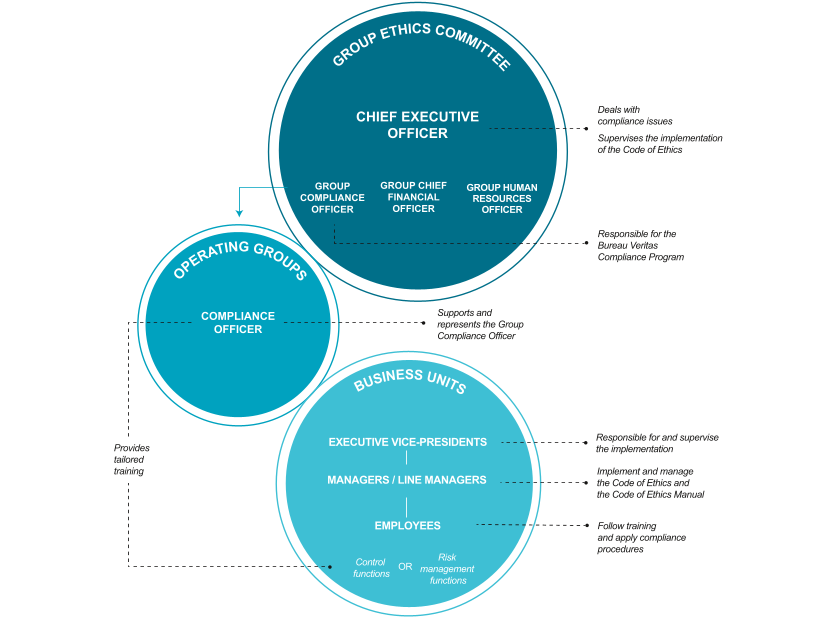

- ●local events to celebrate and recognize differences, and the inclusion of the Week of Solidarity with the Peoples struggling against Racism and Racial Discrimination in the Group’s global inclusion calendar,